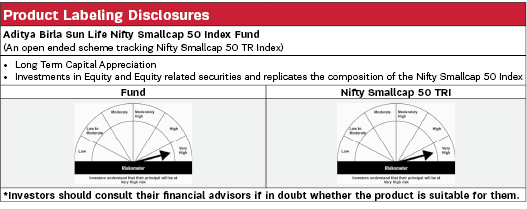

Aditya Birla Sun Life Nifty Smallcap 50 Index Fund |

|

| An open ended scheme tracking Nifty Smallcap 50 TR Index |

| Data as on 31st July 2023 |

|

Fund Details |

|

Investment Objective |

|

| The investment objective of the scheme is to provide returns that closely correspond to the total returns of securities as represented by Nifty Smallcap 50 Index, subject to tracking errors. The Scheme does not guarantee/indicate any returns. There can be no assurance that the schemes’ objectives will be achieved. |

|

|

| Fund Manager | |

|---|---|

| Mr. Haresh Mehta & Mr. Pranav Gupta |

| Managing Fund Since | |

|---|---|

| March 31, 2023 & June 08, 2022 |

| Experience in Managing the Fund | |

|---|---|

| 0.3 Years & 1.1 Years |

| Load Structure (as % of NAV) (Incl. for SIP) | |

|---|---|

| Entry Load | Nil |

| Exit Load | For redemption/switchout of units on or before 15 days from the date of allotment: 0.25% of applicable NAV. For redemption / switchout of units after 15 days from the date of allotment - NIL |

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 1.05% |

| Direct | 0.50% |

| Including additional expenses and goods and service tax on management fees. | |

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 69.61 Crores |

| AUM as on last day | 78.52 Crores |

| Date of Allotment | |

|---|---|

| April 01, 2021 |

| Benchmark | |

|---|---|

| Nifty Smallcap 50 TRI |

| Tracking Error | |

|---|---|

| Regular | 0.23% |

| Direct | 0.23% |

| Application Amount for fresh subscription | |

|---|---|

| ₹ 100 (plus in multiplies of ₹ 1) |

| Min. Addl. Investment | |

|---|---|

| ₹ 100 (plus in multiplies of ₹ 1) |

| SIP | |

|---|---|

| Monthly: Minimum ₹ 100/- |

|

|

||

|---|---|---|

| Regular Plan | Direct Plan | |

| Growth | 12.8349 | 13.0402 |

| IDCW$: | 12.8350 | 13.0378 |

| $Income Distribution cum capital withdrawal | ||

|

PORTFOLIO |

|

| Issuer | % to Net Assets |

Rating |

| Capital Markets | 15.98% | |

| BSE Limited | 3.54% | |

| Central Depository Services (India) Limited | 3.32% | |

| Indian Energy Exchange Limited | 3.00% | |

| Computer Age Management Services Limited | 2.65% | |

| Angel Broking Limited | 2.42% | |

| UTI Asset Management Company Limited | 1.05% | |

| Banks | 10.73% | |

| RBL Bank Limited | 4.37% | |

| City Union Bank Limited | 3.09% | |

| Bank of Maharashtra | 1.08% | |

| IDBI Bank Limited | 1.01% | |

| Indian Overseas Bank | 0.64% | |

| UCO BANK | 0.55% | |

| IT - Software | 8.75% | |

| KPIT Technologies Limited | 5.65% | |

| Birlasoft Limited | 2.24% | |

| Latent View Analytics Limited | 0.85% | |

| Finance | 7.56% | |

| IDFC Limited | 5.09% | |

| Manappuram Finance Limited | 2.47% | |

| Electrical Equipment | 5.09% | |

| Suzlon Energy Limited | 5.09% | |

| Chemicals & Petrochemicals | 4.77% | |

| Gujarat Narmada Valley Fertilizers and Chemicals Limited | 1.70% | |

| Jubilant Ingrevia Limited | 1.00% | |

| Balaji Amines Limited | 0.73% | |

| Anupam Rasayan India Limited | 0.71% | |

| Laxmi Organic Industries Ltd | 0.62% | |

| Non - Ferrous Metals | 4.27% | |

| National Aluminium Company Limited | 2.77% | |

| Hindustan Copper Limited | 1.50% | |

| IT - Services | 3.93% | |

| Cyient Limited | 3.93% | |

| Beverages | 3.63% | |

| Radico Khaitan Limited | 3.63% | |

| Entertainment | 3.50% | |

| PVR Limited | 3.50% | |

| Commercial Services & Supplies | 3.46% | |

| Redington (India) Limited | 3.46% |

| Issuer | % to Net Assets |

Rating |

| Construction | 3.08% | |

| Rail Vikas Nigam Limited | 1.84% | |

| IRB Infrastructure Developers Limited | 1.24% | |

| Telecom - Services | 3.00% | |

| HFCL Limited | 1.73% | |

| Route Mobile Limited | 1.27% | |

| Pharmaceuticals & Biotechnology | 2.88% | |

| J.B. Chemicals & Pharmaceuticals Limited | 2.88% | |

| Healthcare Services | 2.79% | |

| Global Health Ltd/India | 1.65% | |

| METROPOLIS HEALTHCARE LIMITED | 1.13% | |

| Auto Components | 2.03% | |

| Amara Raja Batteries Limited | 2.03% | |

| Industrial Manufacturing | 1.85% | |

| Mazagon Dock Shipbuilders Limited | 1.85% | |

| Aerospace & Defense | 1.82% | |

| Bharat Dynamics Limited | 1.82% | |

| Power | 1.61% | |

| CESC Limited | 1.61% | |

| Fertilizers & Agrochemicals | 1.42% | |

| Chambal Fertilizers & Chemicals Limited | 1.42% | |

| Agricultural Food & other Products | 1.17% | |

| Shree Renuka Sugars Ltd. | 1.17% | |

| Cement & Cement Products | 1.13% | |

| Birla Corporation Limited | 1.13% | |

| Retailing | 1.03% | |

| Medplus Health Services Limited | 1.03% | |

| Textiles & Apparels | 0.98% | |

| Welspun India Limited | 0.98% | |

| Industrial Products | 0.93% | |

| Graphite India Limited | 0.93% | |

| Consumer Durables | 0.77% | |

| Campus Activewear Limited | 0.77% | |

| Food Products | 0.63% | |

| Bikaji Foods International Ltd | 0.63% | |

| Leisure Services | 0.57% | |

| Easy Trip Planners Limited | 0.57% | |

| Petroleum Products | 0.47% | |

| Mangalore Refinery and Petrochemicals Limited | 0.47% | |

| Cash & Current Assets | 0.20% | |

| Total Net Assets | 100.00% |

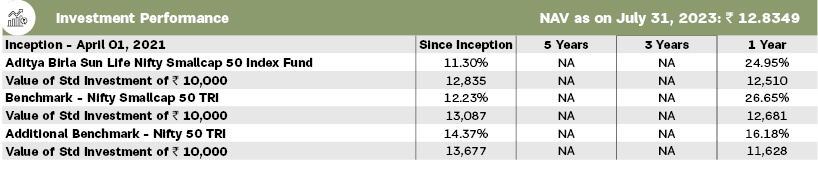

Past performance may or may not be sustained in future. The above performance is of Regular Plan - Growth Option. Kindly note that different plans have different expense structure. Load and Taxes are not considered for computation of returns. When scheme/additional benchmark returns are not available, they have not been shown. Total Schemes Co- Managed by Fund Managers is 15. Total Schemes managed by Mr. Haresh Mehta is 16. Total Schemes managed by Mr. Pranav Gupta is 17. Click here to know more on performance of schemes managed by Fund Managers.

Standard deviation of daily tracking difference computed for a 1 year horizon. If the fund is non-existent for 1 year then since inception returns are considered.

Note: The exit load (if any) rate levied at the time of redemption/switch-out of units will be the rate prevailing at the time of allotment of the corresponding units. Customers may request for a separate Exit Load Applicability Report by calling our toll free numbers 1800-270-7000 or from any of our Investor Service Centers.

# Scheme Benchmark, ## Additional Benchmark

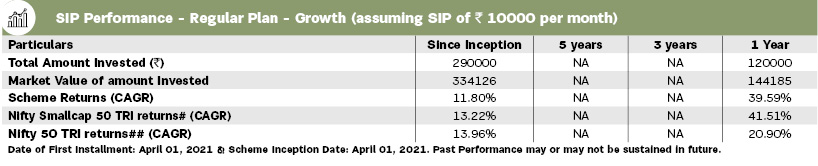

For SIP calculations above, the data assumes the investment of ₹ 10000/- on 1st day of every month or the subsequent working

day. Load & Taxes are not considered for computation of returns. Performance for IDCW option would assume reinvestment

of tax free IDCW declared at the then prevailing NAV. CAGR returns are computed after accounting for the cash flow by using

XIRR method (investment internal rate of return).Where Benchmark returns are not available, they have not been shown.

Past

performance may or may not be sustained in future. Returns greater than 1 year period are compounded annualized. IDCW

are assumed to be reinvested and bonus is adjusted. Load is not taken into consideration. For SIP returns, monthly investment

of equal amounts invested on the 1st day of every month has been considered.