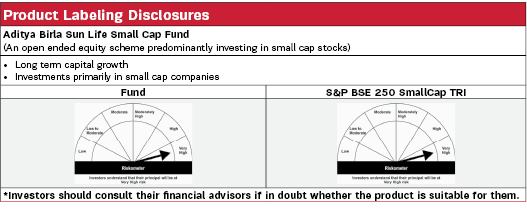

Aditya Birla Sun Life Small Cap Fund |

|

| An open ended equity scheme predominantly investing in small cap stocks. |

| Data as on 31st July 2023 |

|

Fund Details |

|

Investment Objective |

|

| The Scheme seeks to generate consistent long-term capital appreciation by investing predominantly in equity and equity related securities of Small cap companies. | |

Fund Category |

Investment Style |

||

| Small cap Fund |  |

||

| Fund Manager | |

|---|---|

| Mr. Vishal Gajwani & Mr. Dhaval Joshi |

| Managing Fund Since | |

|---|---|

| October 04, 2022 & November 21, 2022 |

| Experience in Managing the Fund | |

|---|---|

| 0.8 years & 0.7 Years |

| Load Structure (as % of NAV) (Incl. for SIP) | |

|---|---|

| Entry Load | Nil |

| Exit Load | For redemption /switchout of units on or before 90 days from the date of allotment: 1.00% of applicable NAV. For redemption / switch-out of units after 90 days from the date of allotment: Nil. |

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 1.92% |

| Direct | 0.89% |

| Including additional expenses and goods and service tax on management fees. | |

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 3925.13 Crores |

| AUM as on last day | 4159.84 Crores |

| Date of Allotment | |

|---|---|

| May 31, 2007 |

| Benchmark | |

|---|---|

| S&P BSE 250 SmallCap TRI |

| Other Parameters | |

|---|---|

| Standard Deviation | 18.11% |

| Sharpe Ratio | 1.55 |

| Beta | 0.91 |

| Portfolio Turnover | 0.38 |

| Note: Standard Deviation, Sharpe Ratio & Beta are calculated on Annualised basis using 3 years history of monthly returns. Risk Free Rate assumed to be 6.6% (FBIL Overnight MIBOR as on 31 July 2023) for calculating Sharpe Ratio | |

| Application Amount for fresh subscription | |

|---|---|

| ₹ 1,000 (plus in multiplies of ₹ 1) |

| Min. Addl. Investment | |

|---|---|

| ₹ 1,000 (plus in multiplies of ₹ 1) |

| SIP | |

|---|---|

| Monthly: Minimum ₹ 1,000/- |

|

|

||

|---|---|---|

| Regular Plan | Direct Plan | |

| Growth | 63.3387 | 70.4948 |

| IDCW$: | 32.1571 | 60.6978 |

| $Income Distribution cum capital withdrawal | ||

|

PORTFOLIO |

|

| Issuer | % to Net Assets |

Rating |

| Finance | 9.14% | |

| Cholamandalam Financial Holdings Limited | 2.51% | |

| Fusion Micro Finance Ltd | 1.50% | |

| Poonawalla Fincorp Limited | 1.38% | |

| Home First Finance Company India Limited | 0.89% | |

| Repco Home Finance Limited | 0.87% | |

| Satin Creditcare Network Limited | 0.80% | |

| Ujjivan Financial Services Limited | 0.78% | |

| IDFC Limited | 0.29% | |

| BEML Land Assets Ltd | 0.13% | |

| Consumer Durables | 7.84% | |

| VIP Industries Limited | 1.71% | |

| Campus Activewear Limited | 1.42% | |

| Kajaria Ceramics Limited | 1.41% | |

| Stylam Industries Ltd | 1.11% | |

| V-Guard Industries Limited | 0.68% | |

| Butterfly Gandhimathi Appliances Ltd | 0.53% | |

| Havells India Limited | 0.37% | |

| Orient Electric Ltd. | 0.36% | |

| Elin Electronics Ltd | 0.14% | |

| IFB Industries Limited | 0.10% | |

| Auto Components | 7.22% | |

| Craftsman Automation Ltd | 1.54% | |

| Rolex Rings Limited | 1.24% | |

| Sundram Fasteners Limited | 1.17% | |

| Sona BLW Precision Forgings Limited | 1.14% | |

| Minda Corporation Limited | 0.73% | |

| SJS Enterprises Pvt Limited | 0.54% | |

| Endurance Technologies Limited | 0.51% | |

| Pricol Limited | 0.35% | |

| Banks | 6.81% | |

| The Federal Bank Limited | 1.98% | |

| Axis Bank Limited | 1.59% | |

| RBL Bank Limited | 1.02% | |

| Bandhan Bank Limited | 0.66% | |

| Bank of India | 0.59% | |

| IDFC First Bank Limited | 0.42% | |

| City Union Bank Limited | 0.38% | |

| Ujjivan Small Finance Bank Limited | 0.17% | |

| Electrical Equipment | 5.51% | |

| TD Power Systems Ltd | 2.12% | |

| Hitachi Energy India Limited | 2.12% | |

| TRIVENI TURBINE LTD | 1.27% | |

| IT - Software | 5.18% | |

| Birlasoft Limited | 1.38% | |

| Rategain Travel Technologies Limited | 1.26% | |

| Sonata Software Limited | 0.83% | |

| Tanla Platforms Limited | 0.71% | |

| Persistent Systems Limited | 0.50% | |

| CE Info Systems Limited | 0.49% | |

| Industrial Products | 4.23% | |

| Prince Pipes & Fittings Limited | 1.46% | |

| RHI Magnesita India Limited | 1.29% | |

| Kirloskar Pneumatic Co Ltd | 1.00% | |

| IFGL Refractories Limited | 0.48% | |

| Commercial Services & Supplies | 3.11% | |

| TeamLease Services Limited | 1.63% | |

| CMS Info Systems Limited | 1.48% | |

| Cement & Cement Products | 3.02% | |

| JK Cement Limited | 2.73% | |

| Orient Cement Limited | 0.30% | |

| Retailing | 2.55% | |

| Go Fashion India Limited | 2.23% | |

| V-Mart Retail Limited | 0.32% | |

| Textiles & Apparels | 2.43% | |

| Gokaldas Exports Ltd | 1.41% | |

| Welspun India Limited | 1.02% | |

| Realty | 2.35% | |

| Brigade Enterprises Limited | 0.93% | |

| Sobha Limited | 0.59% | |

| KEYSTONE REALTORS LIMITED | 0.52% | |

| Sunteck Realty Limited | 0.31% | |

| Food Products | 2.34% | |

| Avanti Feeds Limited | 0.99% | |

| Bikaji Foods International Ltd | 0.83% | |

| Dodla Dairy Limited | 0.52% |

| Issuer | % to Net Assets |

Rating |

| Construction | 2.27% | |

| PNC Infratech Limited | 1.24% | |

| Kalpataru Power Transmission Limited | 1.03% | |

| Industrial Manufacturing | 2.14% | |

| Tega Industries Limited | 1.12% | |

| GMM Pfaudler Limited | 0.62% | |

| Cyient DLM Ltd | 0.40% | |

| Healthcare Services | 1.96% | |

| Fortis Healthcare Limited | 0.92% | |

| Rainbow Childrens Medicare Limited | 0.68% | |

| Yatharth Hospitals | 0.35% | |

| Chemicals & Petrochemicals | 1.93% | |

| Navin Fluorine International Limited | 0.91% | |

| AETHER INDUSTRIES LTD | 0.56% | |

| Clean Science & Technology Limited | 0.38% | |

| Gulshan Polyols Limited | 0.07% | |

| Agricultural Commercial & Construction Vehicles | 1.85% | |

| BEML Limited | 1.20% | |

| Ashok Leyland Limited | 0.65% | |

| IT - Services | 1.72% | |

| Cyient Limited | 1.04% | |

| eMUDHRA LTD | 0.68% | |

| Agricultural Food & other Products | 1.66% | |

| CCL Products (India) Limited | 1.18% | |

| Balrampur Chini Mills Limited | 0.48% | |

| Aerospace & Defense | 1.56% | |

| MTAR Technologies Limited | 1.23% | |

| ideaForge Technology Ltd | 0.33% | |

| Pharmaceuticals & Biotechnology | 1.56% | |

| Eris Lifesciences Limited | 0.65% | |

| Sanofi India Limited | 0.48% | |

| Indoco Remedies Limited | 0.37% | |

| ALEMBIC PHARMACEUTICALS LIMITED | 0.07% | |

| Insurance | 1.53% | |

| Star Health & Allied Insurance Limited | 1.35% | |

| Max Financial Services Limited | 0.18% | |

| Transport Services | 1.46% | |

| Gateway Distriparks Limited | 0.65% | |

| Container Corporation of India Limited | 0.50% | |

| Mahindra Logistics Limited | 0.31% | |

| Beverages | 1.46% | |

| Radico Khaitan Limited | 1.20% | |

| Sula Vineyards Ltd | 0.25% | |

| Entertainment | 1.38% | |

| PVR Limited | 1.03% | |

| NAZARA TECHNOLOGIES LTD | 0.35% | |

| Leisure Services | 1.30% | |

| Restaurant Brands Asia Limited | 0.56% | |

| Chalet Hotels Limited | 0.41% | |

| Sapphire Foods India Ltd | 0.32% | |

| Capital Markets | 1.25% | |

| ICICI Securities Limited | 0.68% | |

| Central Depository Services (India) Limited | 0.31% | |

| Anand Rathi Wealth Limited | 0.25% | |

| Transport Infrastructure | 1.24% | |

| Dreamfolks Services Ltd | 1.24% | |

| Paper Forest & Jute Products | 0.89% | |

| Century Textiles & Industries Limited | 0.89% | |

| Automobiles | 0.45% | |

| Landmark Cars Ltd | 0.45% | |

| Personal Products | 0.43% | |

| Emami Limited | 0.43% | |

| Ferrous Metals | 0.40% | |

| Shyam Metalics & Energy Limited | 0.40% | |

| Financial Technology (Fintech) | 0.39% | |

| PB Fintech Limited | 0.39% | |

| Healthcare Equipment & Supplies | 0.36% | |

| Tarsons Products Limited | 0.36% | |

| Miscellaneous | 0.25% | |

| Netweb Technologies India Ltd | 0.25% | |

| Cash & Current Assets | 8.81% | |

| Total Net Assets | 100.00% |

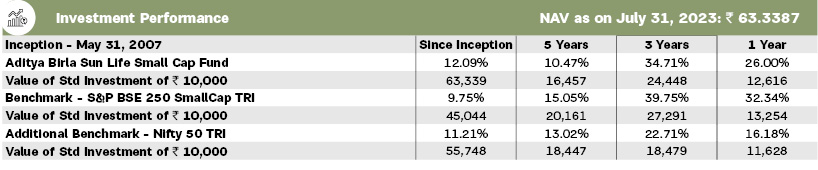

Past performance may or may not be sustained in future. The above performance is of Regular Plan - Growth Option. Kindly note that different plans have different expense structure. Load and Taxes are not considered for computation of returns. When scheme/additional benchmark returns are not available, they have not been shown. Total Schemes Co-Managed by Fund Managers is 1. Total Schemes managed by Mr. Vishal Gajwani is 3. Total Schemes managed by Mr. Dhaval Joshi is 45. Click here to know more on performance of schemes managed by Fund Managers.

Note: The exit load (if any) rate levied at the time of redemption/switch-out of units will be the rate prevailing at the time of allotment of the corresponding units. Customers may request for a separate Exit Load Applicability Report by calling our toll free numbers 1800-270-7000 or from any of our Investor Service Centers.

# Scheme Benchmark, ## Additional Benchmark

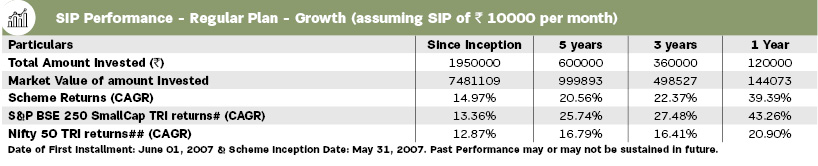

For SIP calculations above, the data assumes the investment of ₹ 10000/- on 1st day of every month or the subsequent working

day. Load & Taxes are not considered for computation of returns. Performance for IDCW option would assume reinvestment

of tax free IDCW declared at the then prevailing NAV. CAGR returns are computed after accounting for the cash flow by using

XIRR method (investment internal rate of return).Where Benchmark returns are not available, they have not been shown.

Past

performance may or may not be sustained in future. Returns greater than 1 year period are compounded annualized. IDCW

are assumed to be reinvested and bonus is adjusted. Load is not taken into consideration. For SIP returns, monthly investment

of equal amounts invested on the 1st day of every month has been considered.