As per expectations, the Monetary Policy Committee decided to keep the repo rate and the stance unchanged from the June 2023 meeting. However, in a surprise move, they decided to ask scheduled commercial banks to maintain an incremental CRR (Cash Reserve Ratio) of 10% on the increase in their NDTL (Net Demand and Time Liabilities) between May 19 and July 28 of 2023. While this change has been projected as a temporary measure to lock in liquidity caused primarily due to deposit of Rs 2000 notes, it will be reviewed on September 8 or earlier as cash requirements increase ahead of the festive season. The move is expected to mop up over Rs 1 lakh Crore.

Fortunately, contrary to expectations by a small section of the market, the MPC (Monetary Policy Committee) looked through the transient spike in inflation due to a spike in tomato prices but communicated their readiness to deploy additional policy tools if inflation showed signs of generalisation risking a de-anchoring of inflation expectations.

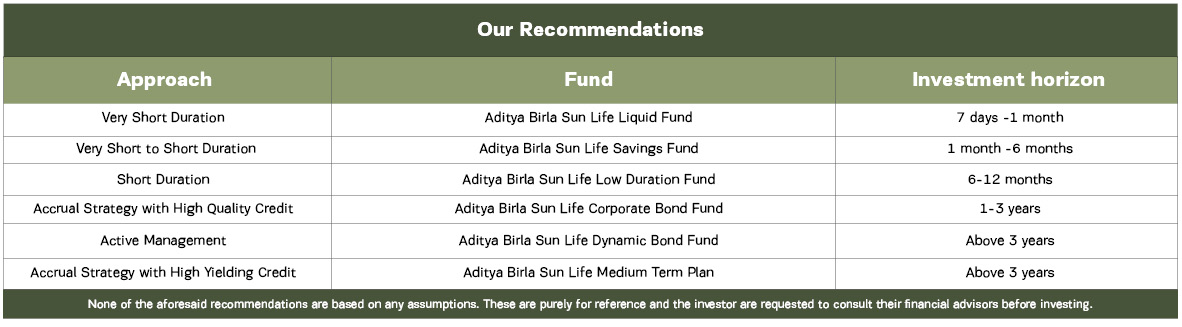

We have long been of the view that rates will stay 'higher for longer' and rate cuts are not on the anvil. We expect no rate cuts over the next 12 months as growth at 6.5% remains near potential and underlying inflation is trending at ~5%. However, we also continue to believe that the bar for further rate hikes is high and will require further or more persistent supply side shocks and / or broadening of price pressures to core inflation. We remain watchful of the risks posed by oil prices which seem to be moving higher again and any signs of re-acceleration in inflation in Developing Market economies.

On the Credit markets front, Corporate India remains in good health due to the balance sheet deleveraging and lower interest rates experienced over the last two years. As expected, operating margins have now stabilized post volatility in the input costs. Hence, from a Credit Underwriting perspective, Corporate India remains well positioned. Credit spreads which were at historic lows have now normalised. As credit growth picks up and liquidity is expected to tighten in the run up to the festive season, we expect credit spreads will also start inching up offering risk adjusted opportunities to invest in similar to the brief spell when liquidity was tight earlier this year. Supply of good quality investment grade paper has finally increased in the bond market with the arbitrage with banking rates being nullified. We continue to prefer cash flow generating companies and sectors with good promoters, performance track record, and a conservative capital structure and accordingly, will selectively invest in those sectors and companies that meet these criteria.

Source - ABSLAMC internal research, RBI press Releases, Data as of 10th August 2023

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.