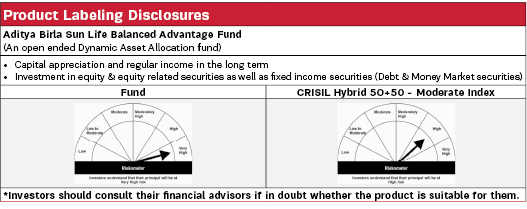

Aditya Birla Sun Life Balanced Advantage Fund |

|

| An open ended Dynamic Asset Allocation fund |

| Data as on 31st July 2023 |

|

Fund Details |

|

Investment Objective |

|

| The primary objective of the Scheme is to generate long term growth of capital and income distribution with relatively lower volatility by investing in a dynamically balanced portfolio of Equity & Equity linked investments and fixed-income securities. There can be no assurance that the investment objective of the Scheme will be realized. | |

Fund Category |

Investment Style |

||

| Dynamic Asset Allocation or Balanced Advantage |  |

||

| Fund Manager | |

|---|---|

| Mr. Mohit Sharma, Mr. Lovelish Solanki & Mr. Vishal Gajwani |

| Managing Fund Since | |

|---|---|

| April 01, 2017, October 09, 2019 & April 01, 2022 |

| Experience in Managing the Fund | |

|---|---|

| 6.3 years, 3.8 years & 1.3 years |

| Load Structure (as % of NAV) (Incl. for SIP) | |

|---|---|

| Entry Load | Nil |

| Exit Load | In respect of each purchase/switch-in of Units: For redemption/switch out of units on or before 7 days from the date of allotment: 0.25% of applicable NAV. For redemption/switch out of units after 7 days from the date of allotment: Nil |

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 1.79% |

| Direct | 0.75% |

| Including additional expenses and goods and service tax on management fees. | |

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 6730.35 Crores |

| AUM as on last day | 6817.95 Crores |

| Date of Allotment | |

|---|---|

| April 25, 2000 |

| Benchmark | |

|---|---|

| CRISIL Hybrid 50+50 - Moderate Index |

| Other Parameters | |

|---|---|

| Modified Duration | 1.12 years |

| Average Maturity | 1.28 years |

| Yield to Maturity | 7.79% |

| Macaulay Duration | 1.16 years |

| Portfolio Turnover | 2.26 |

| Standard Deviation | 8.31% |

| Sharpe Ratio | 0.97 |

| Beta | 1.00 |

| Net Equity Exposure | 52.22% |

| (S&P BSE 100 Index Trailing PE “23.16”) | |

| Note: Standard Deviation, Sharpe Ratio & Beta are calculated on Annualised basis using 3 years history of monthly returns.Risk Free Rate assumed to be 6.6% (FBIL Overnight MIBOR as on 31 July 2023) for calculating Sharpe Ratio | |

| Application Amount for fresh subscription | |

|---|---|

| ₹ 100 (plus in multiplies of ₹ 1) |

| Min. Addl. Investment | |

|---|---|

| ₹ 100 (plus in multiplies of ₹ 1) |

| SIP | |

|---|---|

| Monthly: Minimum ₹ 100/- |

|

|

||

|---|---|---|

| Regular Plan | Direct Plan | |

| Growth | 82.4500 | 91.5500 |

| IDCW$: | 23.8500 | 26.5300 |

| $Income Distribution cum capital withdrawal | ||

|

PORTFOLIO |

|

| Issuer | % to Net Assets |

Rating |

| Fixed rates bonds - Corporate | 19.64% | |

| Tata Capital Limited | 2.15% | CRISIL AAA |

| HDFC Bank Limited | 1.25% | CRISIL AAA |

| Bharti Telecom Limited | 1.17% | CRISIL AA+ |

| Bharti Telecom Limited | 1.10% | CRISIL AA+ |

| Muthoot Finance Limited | 1.10% | ICRA AA+ |

| National Bank For Agriculture and Rural Development | 1.03% | CRISIL AAA |

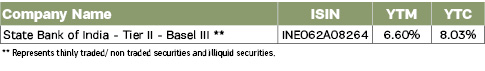

| State Bank of India - Tier II - Basel III | 0.98% | ICRA AAA |

| ICICI Home Finance Company Limited | 0.87% | ICRA AAA |

| HDB Financial Services Limited | 0.87% | CRISIL AAA |

| Muthoot Finance Limited | 0.81% | ICRA AA+ |

| Shriram Finance Ltd | 0.74% | CRISIL AA+ |

| LIC Housing Finance Limited | 0.73% | CRISIL AAA |

| Kotak Mahindra Prime Limited | 0.72% | CRISIL AAA |

| Kotak Mahindra Prime Limited | 0.72% | CRISIL AAA |

| Manappuram Finance Limited | 0.51% | CRISIL AA |

| Manappuram Finance Limited | 0.51% | CRISIL AA |

| Summit Digitel Infrastructure Private Limited | 0.50% | CRISIL AAA |

| HDFC Bank Limited | 0.44% | CRISIL AAA |

| REC Limited | 0.44% | ICRA AAA |

| Muthoot Finance Limited | 0.44% | ICRA AA+ |

| REC Limited | 0.39% | CRISIL AAA |

| Cholamandalam Investment and Finance Company Limited | 0.37% | ICRA AA+ |

| Bharti Hexacom Limited | 0.36% | CRISIL AA+ |

| Tata Projects Limited | 0.36% | IND AA |

| Cholamandalam Investment and Finance Company Limited | 0.29% | IND AA+ |

| Tata Capital Financial Services Limited | 0.29% | ICRA AAA |

| REC Limited | 0.15% | CRISIL AAA |

| Small Industries Development Bank of India | 0.15% | ICRA AAA |

| Small Industries Development Bank of India | 0.14% | ICRA AAA |

| Tata Motors Finance Limited | 0.07% | CRISIL AA |

| NTPC Limited | 0.00% | CRISIL AAA |

| Banks | 19.02% | |

| HDFC Bank Limited | 7.34% | |

| ICICI Bank Limited | 4.90% | |

| State Bank of India | 1.96% | |

| Axis Bank Limited | 1.77% | |

| Kotak Mahindra Bank Limited | 0.89% | |

| IndusInd Bank Limited | 0.83% | |

| The Federal Bank Limited | 0.60% | |

| Bandhan Bank Limited | 0.27% | |

| IDFC First Bank Limited | 0.22% | |

| Canara Bank | 0.17% | |

| City Union Bank Limited | 0.07% | |

| MUTUAL FUNDS | 6.10% | |

| Aditya Birla Sun Life Money Manager Fund - Growth - Direct Plan | 2.33% | |

| Aditya Birla Sun Life Liquid Fund - Growth - Direct Plan | 1.94% | |

| Aditya Birla Sunlife Floating Rate Fund - Direct Plan - Growth | 1.83% | |

| IT - Software | 5.35% | |

| Infosys Limited | 2.45% | |

| Coforge Limited | 0.80% | |

| LTIMindtree Ltd | 0.68% | |

| HCL Technologies Limited | 0.59% | |

| Tata Consultancy Services Limited | 0.53% | |

| Tech Mahindra Limited | 0.30% | |

| Petroleum Products | 3.75% | |

| Reliance Industries Limited | 3.54% | |

| Bharat Petroleum Corporation Limited | 0.21% | |

| Pharmaceuticals & Biotechnology | 3.10% | |

| Sun Pharmaceutical Industries Limited | 1.06% | |

| Ajanta Pharmaceuticals Limited | 0.61% | |

| Cipla Limited | 0.33% | |

| Sanofi India Limited | 0.33% | |

| Dr. Reddys Laboratories Limited | 0.26% | |

| Biocon Limited | 0.17% | |

| Gland Pharma Limited | 0.12% | |

| Mankind Pharma Ltd | 0.11% | |

| Aurobindo Pharma Limited | 0.07% | |

| Lupin Limited | 0.03% | |

| Diversified FMCG | 2.84% | |

| ITC Limited | 1.97% | |

| Hindustan Unilever Limited | 0.87% | |

| Automobiles | 2.81% | |

| Maruti Suzuki India Limited | 0.92% | |

| Mahindra & Mahindra Limited | 0.76% | |

| Tata Motors Limited | 0.65% | |

| Hero MotoCorp Limited | 0.25% | |

| Bajaj Auto Limited | 0.15% | |

| Tata Motors Limited | 0.08% | |

| Floating rates notes - Corporate | 2.57% | |

| Bharti Telecom Limited | 1.47% | CRISIL AA+ |

| Bharti Telecom Limited | 0.73% | CRISIL AA+ |

| Vedanta Limited | 0.37% | CRISIL AA |

| Cement & Cement Products | 2.45% | |

| Ambuja Cements Limited | 0.76% | |

| ACC Limited | 0.59% | |

| UltraTech Cement Limited | 0.55% | |

| Grasim Industries Limited | 0.36% | |

| J.K. Lakshmi Cement Limited | 0.19% | |

| Transport Infrastructure | 2.34% | |

| Adani Ports and Special Economic Zone Limited | 1.28% | |

| GMR Infrastructure Limited | 0.77% | |

| IRB InvIT Fund | 0.28% | |

| Finance | 2.33% | |

| Bajaj Finance Limited | 1.00% | |

| Bajaj Finserv Limited | 0.61% | |

| Jio Financial Services Limited | 0.36% | |

| Shriram Finance Ltd | 0.18% | |

| Mahindra & Mahindra Financial Services Limited | 0.11% | |

| Fusion Micro Finance Ltd | 0.07% | |

| Personal Products | 2.22% | |

| Godrej Consumer Products Limited | 0.62% | |

| Dabur India Limited | 0.62% | |

| Gillette India Limited | 0.59% | |

| Emami Limited | 0.39% | |

| Industrial Products | 1.91% | |

| TIMKEN INDIA LTD | 0.64% | |

| POLYCAB INDIA Limited | 0.42% | |

| Bharat Forge Limited | 0.39% | |

| IFGL Refractories Limited | 0.25% | |

| Mold-Tek Packaging Limited | 0.20% |

| Issuer | % to Net Assets |

Rating |

| Telecom - Services | 1.90% | |

| Bharti Airtel Limited | 1.02% | |

| Bharti Airtel Limited | 0.56% | |

| Tata Communications Limited | 0.32% | |

| Insurance | 1.68% | |

| SBI Life Insurance Company Limited | 0.85% | |

| HDFC Life Insurance Company Limited | 0.54% | |

| ICICI Prudential Life Insurance Company Limited | 0.30% | |

| Consumer Durables | 1.51% | |

| Crompton Greaves Consumer Electricals Limited | 0.38% | |

| Havells India Limited | 0.36% | |

| Voltas Limited | 0.27% | |

| Akzo Nobel India Limited | 0.23% | |

| Whirlpool of India Limited | 0.21% | |

| Campus Activewear Limited | 0.03% | |

| Titan Company Limited | 0.03% | |

| Government Bond | 1.45% | |

| 7.26% GOVERNMENT OF INDIA 06FEB33 | 0.74% | SOV |

| 5.22% GOVERNMENT OF INDIA 15JUN25 G-SEC | 0.71% | SOV |

| Construction | 1.38% | |

| Larsen & Toubro Limited | 1.34% | |

| GR Infraprojects Limited | 0.03% | |

| Sadbhav Engineering Limited | 0.01% | |

| Power | 1.25% | |

| NTPC Limited | 1.18% | |

| CESC Limited | 0.06% | |

| Healthcare Services | 1.16% | |

| Apollo Hospitals Enterprise Limited | 0.31% | |

| Vijaya Diagnostic Centre Limited | 0.25% | |

| Syngene International Limited | 0.25% | |

| METROPOLIS HEALTHCARE LIMITED | 0.18% | |

| Fortis Healthcare Limited | 0.17% | |

| Auto Components | 1.16% | |

| Samvardhana Motherson International Limited | 0.59% | |

| Sona BLW Precision Forgings Limited | 0.57% | |

| Beverages | 0.87% | |

| United Spirits Limited | 0.87% | |

| Retailing | 0.86% | |

| Aditya Birla Fashion and Retail Limited | 0.50% | |

| FSN E-Commerce Ventures Limited | 0.14% | |

| CarTrade Tech Limited | 0.12% | |

| Vedant Fashions Private Limited | 0.09% | |

| Food Products | 0.83% | |

| Britannia Industries Limited | 0.68% | |

| Avanti Feeds Limited | 0.08% | |

| Heritage Foods Limited | 0.06% | |

| Nestle India Limited | 0.01% | |

| Ferrous Metals | 0.72% | |

| NMDC Steel Ltd | 0.37% | |

| Tata Steel Limited | 0.27% | |

| Shyam Metalics & Energy Limited | 0.08% | |

| Gas | 0.70% | |

| Indraprastha Gas Limited | 0.50% | |

| Gujarat Gas Limited | 0.19% | |

| Consumable Fuels | 0.64% | |

| Coal India Limited | 0.64% | |

| Realty | 0.61% | |

| DLF Limited | 0.61% | |

| Electrical Equipment | 0.54% | |

| Siemens Limited | 0.54% | |

| Chemicals & Petrochemicals | 0.46% | |

| SRF Limited | 0.46% | |

| Non - Ferrous Metals | 0.43% | |

| Hindalco Industries Limited | 0.43% | |

| Transport Services | 0.43% | |

| InterGlobe Aviation Limited | 0.24% | |

| Container Corporation of India Limited | 0.19% | |

| Minerals & Mining | 0.41% | |

| NMDC Limited | 0.41% | |

| Leisure Services | 0.37% | |

| Jubilant Foodworks Limited | 0.30% | |

| Restaurant Brands Asia Limited | 0.07% | |

| Agricultural Food & other Products | 0.20% | |

| Marico Limited | 0.20% | |

| Media | 0.05% | |

| Jagran Prakashan Limited | 0.05% | |

| Miscellaneous | 0.02% | |

| Netweb Technologies India Ltd | 0.02% | |

| INDEX OPTION | 0.02% | |

| Nifty 50 Index | 0.01% | |

| Nifty 50 Index | 0.00% | |

| Nifty 50 Index | 0.00% | |

| INDEX FUTURE | -4.47% | |

| Nifty 50 Index | -4.47% | |

| EQUITY FUTURE | -7.51% | |

| Nestle India Limited | -0.01% | |

| ACC Limited | -0.01% | |

| Apollo Hospitals Enterprise Limited | -0.02% | |

| Titan Company Limited | -0.03% | |

| Lupin Limited | -0.03% | |

| Coal India Limited | -0.05% | |

| Samvardhana Motherson International Limited | -0.06% | |

| Aurobindo Pharma Limited | -0.07% | |

| The Federal Bank Limited | -0.09% | |

| Tata Motors Limited | -0.11% | |

| Grasim Industries Limited | -0.13% | |

| DLF Limited | -0.15% | |

| Canara Bank | -0.17% | |

| SRF Limited | -0.18% | |

| Ambuja Cements Limited | -0.19% | |

| Kotak Mahindra Bank Limited | -0.22% | |

| HCL Technologies Limited | -0.24% | |

| Siemens Limited | -0.26% | |

| Dr. Reddys Laboratories Limited | -0.27% | |

| Tech Mahindra Limited | -0.28% | |

| Maruti Suzuki India Limited | -0.31% | |

| ICICI Bank Limited | -0.39% | |

| Bajaj Finserv Limited | -0.61% | |

| Axis Bank Limited | -0.69% | |

| GMR Infrastructure Limited | -0.78% | |

| HDFC Bank Limited | -1.05% | |

| Adani Ports and Special Economic Zone Limited | -1.12% | |

| Cash & Current Assets | 15.93% | |

| Total Net Assets | 100.00% |

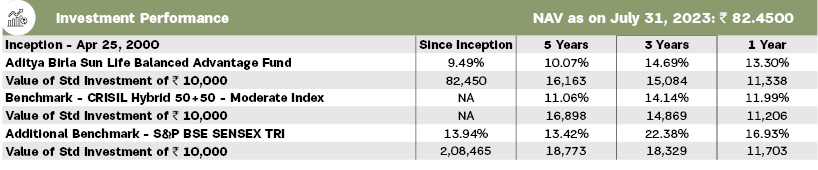

Past performance may or may not be sustained in future. The above performance is of Regular Plan - Growth Option. Kindly note that different plans have different expense structure. Load and Taxes are not considered for computation of returns. When scheme/additional benchmark returns are not available, they have not been shown. Total Schemes Co-Managed by Fund Managers is 1. Total Schemes managed by Mr. Mohit Sharma is 20. Total Schemes managed by Mr. Vishal Gajwani is 3. Total Schemes managed by Mr. Lovelish Solanki is 2. Click here to know more on performance of schemes managed by Fund Managers.

Note: The exit load (if any) rate levied at the time of redemption/switch-out of units will be the rate prevailing at the time of allotment of the corresponding units. Customers may request for a separate Exit Load Applicability Report by calling our toll free numbers 1800-270-7000 or from any of our Investor Service Centers.

# Scheme Benchmark, ## Additional Benchmark

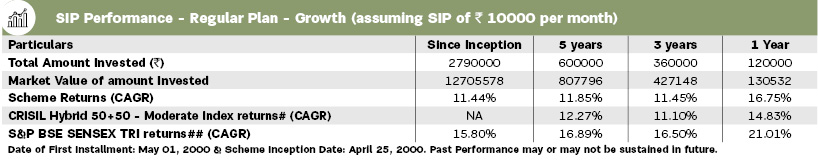

For SIP calculations above, the data assumes the investment of ₹ 10000/- on 1st day of every month or the subsequent working

day. Load & Taxes are not considered for computation of returns. Performance for IDCW option would assume reinvestment

of tax free IDCW declared at the then prevailing NAV. CAGR returns are computed after accounting for the cash flow by using

XIRR method (investment internal rate of return).Where Benchmark returns are not available, they have not been shown.

Past

performance may or may not be sustained in future. Returns greater than 1 year period are compounded annualized. IDCW

are assumed to be reinvested and bonus is adjusted. Load is not taken into consideration. For SIP returns, monthly investment

of equal amounts invested on the 1st day of every month has been considered.