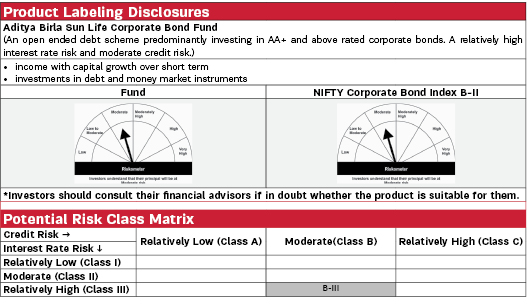

Aditya Birla Sun Life Corporate Bond Fund |

|

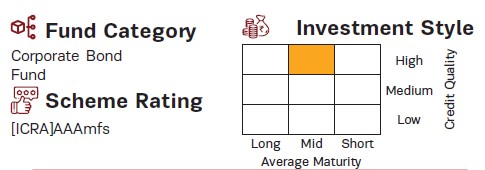

| (An open ended debt scheme predominantly investing in AA+ and above rated corporate bonds. A relatively high interest rate risk and moderate credit risk.) |

| Data as on 31st July 2023 |

|

Fund Details |

|

Investment Objective |

|

| The investment objective of the scheme is to generate optimal returns with high liquidity through active management of Investment Objective the portfolio by investing in High Quality Debt and Money Market Instruments | |

|

| Fund Manager | |

|---|---|

| Mr. Kaustubh Gupta & Mr. Dhaval Joshi |

| Managing Fund Since | |

|---|---|

| April 12, 2021 & November 21, 2022 |

| Experience in Managing the Fund | |

|---|---|

| 2.3 years & 0.7 years |

| Load Structure (as % of NAV) (Incl. for SIP) | |

|---|---|

| Entry Load | Nil |

| Exit Load | Nil |

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 0.50% |

| Direct | 0.31% |

| Including additional expenses and goods and service tax on management fees. | |

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 17888.33 Crores |

| AUM as on last day | 17961.37 Crores |

| Date of Allotment | |

|---|---|

| March 3, 1997 |

| Benchmark | |

|---|---|

| NIFTY Corporate Bond Index B-II |

| Other Parameters | |

|---|---|

| Modified Duration | 2.18 years |

| Average Maturity | 2.81 years |

| Yield to Maturity | 7.62% |

| Macaulay Duration | 2.31 years |

| Application Amount for fresh subscription | |

|---|---|

| ₹ 100 (plus in multiplies of ₹ 1) |

| Min. Addl. Investment | |

|---|---|

| ₹ 100 (plus in multiplies of ₹ 1) |

| SIP | |

|---|---|

| Monthly: Minimum ₹ 100/- |

|

|

||

|---|---|---|

Regular Plan |

Direct Plan |

|

| Growth | 96.8884 |

98.1919 |

| IDCW$: | 12.6056 |

11.1843 |

| Monthly IDCW$: | 12.3330 |

12.4779 |

| $Income Distribution cum capital withdrawal | ||

|

PORTFOLIO |

|

| Issuer | % to Net Assets |

Rating |

| Fixed rates bonds - Corporate | 65.02% | |

| Mahindra & Mahindra Financial Services Limited | 3.35% | IND AAA |

| National Bank For Agriculture and Rural Development | 2.64% | CRISIL AAA |

| National Bank For Agriculture and Rural Development | 2.39% | CRISIL AAA |

| REC Limited | 2.36% | ICRA AAA |

| Small Industries Development Bank of India | 2.01% | CRISIL AAA |

| HDFC Bank Limited | 1.95% | ICRA AAA |

| HDFC Bank Limited | 1.95% | ICRA AAA |

| Power Finance Corporation Limited | 1.77% | ICRA AAA |

| Small Industries Development Bank of India | 1.40% | ICRA AAA |

| Small Industries Development Bank of India | 1.39% | ICRA AAA |

| Sikka Ports and Terminals Limited | 1.36% | CRISIL AAA |

| Small Industries Development Bank of India | 1.33% | ICRA AAA |

| HDFC Bank Limited | 1.25% | ICRA AAA |

| Embassy Office Parks REIT | 1.25% | CRISIL AAA |

| National Bank For Agriculture and Rural Development | 1.22% | ICRA AAA |

| National Housing Bank | 1.20% | ICRA AAA |

| Bajaj Housing Finance Limited | 1.17% | CRISIL AAA |

| HDFC Bank Limited | 1.15% | ICRA AAA |

| HDFC Bank Limited | 1.14% | ICRA AAA |

| Small Industries Development Bank of India | 1.11% | CRISIL AAA |

| HDFC Bank Limited | 1.09% | CRISIL AAA |

| Larsen & Toubro Limited | 0.98% | CRISIL AAA |

| Fullerton India Credit Company Limited | 0.98% | CRISIL AAA |

| Power Finance Corporation Limited | 0.90% | ICRA AAA |

| Summit Digitel Infrastructure Private Limited | 0.84% | CRISIL AAA |

| Embassy Office Parks REIT | 0.83% | CRISIL AAA |

| Pipeline Infrastructure Limited | 0.83% | CRISIL AAA |

| Oil & Natural Gas Corporation Limited | 0.82% | ICRA AAA |

| HDFC Bank Limited | 0.79% | ICRA AAA |

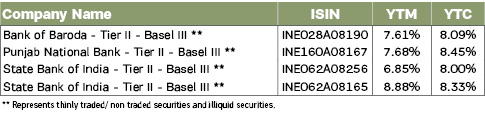

| State Bank of India - Tier II - Basel III | 0.78% | ICRA AAA |

| Bajaj Finance Limited | 0.78% | CRISIL AAA |

| Bank of Baroda - Tier II - Basel III | 0.74% | CARE AAA |

| National Bank For Agriculture and Rural Development | 0.72% | CRISIL AAA |

| HDB Financial Services Limited | 0.72% | CRISIL AAA |

| Summit Digitel Infrastructure Private Limited | 0.67% | CRISIL AAA |

| REC Limited | 0.61% | ICRA AAA |

| LIC Housing Finance Limited | 0.56% | CRISIL AAA |

| L&T Finance Limited | 0.56% | CARE AAA |

| LIC Housing Finance Limited | 0.56% | CRISIL AAA |

| HDFC Bank Limited | 0.55% | ICRA AAA |

| IndInfravit Trust | 0.55% | ICRA AAA |

| Small Industries Development Bank of India | 0.55% | ICRA AAA |

| REC Limited | 0.54% | ICRA AAA |

| Small Industries Development Bank of India | 0.53% | ICRA AAA |

| Power Finance Corporation Limited | 0.49% | ICRA AAA |

| REC Limited | 0.47% | ICRA AAA |

| Jamnagar Utilities & Power Private Limited | 0.46% | CRISIL AAA |

| National Bank For Agriculture and Rural Development | 0.44% | ICRA AAA |

| Sundaram Home Finance Limited | 0.42% | CRISIL AAA |

| Power Finance Corporation Limited | 0.41% | ICRA AAA |

| Small Industries Development Bank of India | 0.41% | ICRA AAA |

| Mangalore Refinery and Petrochemicals Limited | 0.40% | CARE AAA |

| HDFC Credila Financial Services Pvt Limited | 0.39% | ICRA AAA |

| Sundaram Home Finance Limited | 0.37% | ICRA AAA |

| Bajaj Housing Finance Limited | 0.34% | CRISIL AAA |

| Sundaram Home Finance Limited | 0.33% | ICRA AAA |

| HDFC Bank Limited | 0.33% | ICRA AAA |

| Mindspace Business Parks REIT | 0.32% | ICRA AAA |

| Indian Railway Finance Corporation Limited | 0.31% | CRISIL AAA |

| ICICI Home Finance Company Limited | 0.31% | ICRA AAA |

| Indian Oil Corporation Limited | 0.30% | CRISIL AAA |

| Embassy Office Parks REIT | 0.28% | CRISIL AAA |

| LIC Housing Finance Limited | 0.28% | CRISIL AAA |

| Mindspace Business Parks REIT | 0.28% | CRISIL AAA |

| HDB Financial Services Limited | 0.28% | CRISIL AAA |

| National Bank For Agriculture and Rural Development | 0.28% | ICRA AAA |

| Mahindra & Mahindra Financial Services Limited | 0.28% | IND AAA |

| Tata Capital Limited | 0.28% | CRISIL AAA |

| REC Limited | 0.28% | ICRA AAA |

| ICICI Home Finance Company Limited | 0.28% | ICRA AAA |

| REC Limited | 0.28% | ICRA AAA |

| National Bank For Agriculture and Rural Development | 0.27% | ICRA AAA |

| Bajaj Housing Finance Limited | 0.22% | CRISIL AAA |

| Sundaram Home Finance Limited | 0.22% | ICRA AAA |

| HDFC Bank Limited | 0.22% | ICRA AAA |

| Tata Capital Financial Services Limited | 0.20% | ICRA AAA |

| Mahindra & Mahindra Financial Services Limited | 0.19% | CRISIL AAA |

| REC Limited | 0.17% | ICRA AAA |

| Bajaj Finance Limited | 0.16% | CRISIL AAA |

| National Bank For Agriculture and Rural Development | 0.16% | ICRA AAA |

| State Bank of India | 0.14% | CRISIL AAA |

| National Bank For Agriculture and Rural Development | 0.14% | ICRA AAA |

| HDB Financial Services Limited | 0.14% | CRISIL AAA |

| HDFC Bank Limited | 0.14% | ICRA AAA |

| HDFC Bank Limited | 0.14% | ICRA AAA |

| Kotak Mahindra Prime Limited | 0.14% | CRISIL AAA |

| Small Industries Development Bank of India | 0.14% | CARE AAA |

| National Bank For Agriculture and Rural Development | 0.14% | ICRA AAA |

| Kotak Mahindra Prime Limited | 0.12% | CRISIL AAA |

| Power Finance Corporation Limited | 0.11% | ICRA AAA |

| REC Limited | 0.11% | CRISIL AAA |

| Kotak Mahindra Prime Limited | 0.11% | CRISIL AAA |

| Power Finance Corporation Limited | 0.08% | ICRA AAA |

| Power Finance Corporation Limited | 0.08% | ICRA AAA |

| Power Finance Corporation Limited | 0.08% | ICRA AAA |

| Bajaj Finance Limited | 0.08% | CRISIL AAA |

| National Bank For Agriculture and Rural Development | 0.08% | CRISIL AAA |

| Punjab National Bank - Tier II - Basel III | 0.08% | IND AAA |

| Tata Capital Financial Services Limited | 0.07% | ICRA AAA |

| Aditya Birla Finance Limited | 0.07% | ICRA AAA |

| ICICI Home Finance Company Limited | 0.07% | ICRA AAA |

| Aditya Birla Finance Limited | 0.06% | ICRA AAA |

| Axis Finance Limited | 0.06% | CRISIL AAA |

| Power Finance Corporation Limited | 0.06% | ICRA AAA |

| NIIF Infrastructure Finance Limited | 0.06% | ICRA AAA |

| Power Finance Corporation Limited | 0.06% | ICRA AAA |

| Kotak Mahindra Investments Limited | 0.05% | CRISIL AAA |

| Aditya Birla Finance Limited | 0.05% | ICRA AAA |

| HDFC Bank Limited | 0.04% | CRISIL AAA |

| Tata Capital Financial Services Limited | 0.03% | ICRA AAA |

| HDFC Bank Limited | 0.03% | CRISIL AAA |

| REC Limited | 0.03% | ICRA AAA |

| Power Finance Corporation Limited | 0.03% | ICRA AAA |

| Power Finance Corporation Limited | 0.03% | ICRA AAA |

| REC Limited | 0.03% | ICRA AAA |

| Power Finance Corporation Limited | 0.03% | ICRA AAA |

| LIC Housing Finance Limited | 0.03% | CRISIL AAA |

| LIC Housing Finance Limited | 0.03% | CRISIL AAA |

| Power Finance Corporation Limited | 0.03% | ICRA AAA |

| LIC Housing Finance Limited | 0.02% | CRISIL AAA |

| REC Limited | 0.02% | ICRA AAA |

| Power Finance Corporation Limited | 0.01% | ICRA AAA |

| LIC Housing Finance Limited | 0.01% | CRISIL AAA |

| REC Limited | 0.01% | CRISIL AAA |

| National Bank For Agriculture and Rural Development | 0.01% | ICRA AAA |

| Government Bond | 15.65% | |

| 4.70% INDIA GOVT BOND 22SEP2033 FRB | 3.92% | SOV |

| 4.45% GOI FRB 30OCT2034 | 3.34% | SOV |

| 7.26% GOVERNMENT OF INDIA 06FEB33 | 2.53% | SOV |

| GOI 07.41% 19DEC2036 | 1.52% | SOV |

| 7.06% GOI 10APR28 | 1.16% | SOV |

| 7.38% GOI 20JUN2027 | 0.64% | SOV |

| 7.26% GOI 22AUG2032 | 0.39% | SOV |

| 6.97% GOI (MD 06/09/2026) | 0.36% | SOV |

| 7.17% GOVERNMENT OF INDIA 18APR30 | 0.28% | SOV |

| 7.35% GOI (MD 22/06/2024) | 0.22% | SOV |

| 6.54% GOI 17JAN2032 | 0.21% | SOV |

| 7.18% GOI 24-Jul-2037 | 0.17% | SOV |

| GOI 06.79% 26DEC2029 | 0.16% | SOV |

| 5.63% GOI 12APR2026 | 0.16% | SOV |

| 8.60% GOI (MD 02/06/2028) | 0.14% | SOV |

| 8.33% GOI (MD 09/07/2026) | 0.12% | SOV |

| 6.79% GOI (MD 15/05/2027) | 0.10% | SOV |

| 7.59% GOI(MD 11/01/2026) | 0.06% | SOV |

| 8.83% GOI (MD 25/11/2023) | 0.06% | SOV |

| 7.57% GOI (MD 17/06/2033) | 0.04% | SOV |

| 6.22% GOVERNMENT OF INDIA 16MAR35 G-SEC | 0.02% | SOV |

| 6.67% GOVERNMENT OF INDIA 17DEC50 G-SEC | 0.02% | SOV |

| 5.15% GOVERNMENT OF INDIA 09NOV25 G-SEC | 0.01% | SOV |

| 4.04% GOI FRB 04OCT2028 | 0.01% | SOV |

| 07.26% GOI (MD 14/01/2029) | 0.00% | SOV |

| 7.17% GOI (MD 08/01/2028) | 0.00% | SOV |

| Money Market Instruments | 5.78% | |

| Canara Bank | 1.21% | CRISIL A1+ |

| Axis Bank Limited | 1.20% | ICRA A1+ |

| ICICI Bank Limited | 0.93% | ICRA A1+ |

| Small Industries Development Bank of India | 0.68% | CRISIL A1+ |

| Axis Bank Limited | 0.54% | ICRA A1+ |

| Axis Finance Limited | 0.53% | CRISIL A1+ |

| Punjab National Bank | 0.28% | ICRA A1+ |

| Axis Bank Limited | 0.27% | ICRA A1+ |

| Panatone Finvest Limited | 0.13% | CRISIL A1+ |

| Floating rates notes - Corporate | 4.37% | |

| HDFC Bank Limited | 1.11% | ICRA AAA |

| DME Development Limited | 0.31% | CRISIL AAA |

| DME Development Limited | 0.31% | CRISIL AAA |

| DME Development Limited | 0.30% | CARE AAA |

| DME Development Limited | 0.30% | CRISIL AAA |

| DME Development Limited | 0.30% | CRISIL AAA |

| DME Development Limited | 0.30% | CRISIL AAA |

| Issuer | % to Net Assets |

Rating |

| DME Development Limited | 0.30% | CRISIL AAA |

| DME Development Limited | 0.30% | CRISIL AAA |

| DME Development Limited | 0.30% | CRISIL AAA |

| DME Development Limited | 0.30% | CRISIL AAA |

| Axis Finance Limited | 0.20% | CRISIL AAA |

| HDFC Bank Limited | 0.03% | ICRA AAA |

| State Government bond | 2.52% | |

| 8.43% RAJASTHAN 26NOV2024 SDL | 0.57% | SOV |

| 8.25% GUJARAT 12DEC2024 SDL | 0.56% | SOV |

| 6.82% RAJASTHAN 18SEP2024 SDL | 0.44% | SOV |

| 8.44% MAHARASHTRA 26NOV2024 SDL | 0.20% | SOV |

| 6.70% TAMIL NADU 16OCT24 SDL | 0.14% | SOV |

| 8.22% TAMIL NADU 09DEC2025 SDL | 0.06% | SOV |

| 8.52% UTTAR PRADESH 21MAR2025 SDL | 0.06% | SOV |

| 8.44% TAMIL NADU 12NOV2024 SDL | 0.06% | SOV |

| 8.59% UTTAR PRADESH 10MAR2025 SDL | 0.03% | SOV |

| 8.16% KARNATAKA 26NOV2025 SDL | 0.03% | SOV |

| GUJARAT GUJARA 8.23 09/09/25 | 0.03% | SOV |

| 8.06% HARYANA 04JUL2026 SDL | 0.03% | SOV |

| ANDHRA PRADESH ANDHRA 9.84 02/26/24 | 0.03% | SOV |

| 7.99% MAHARASHTRA 28OCT2025 SDL | 0.03% | SOV |

| 7.96% Gujarat SDL (14/10/2025) | 0.03% | SOV |

| 7.96% Maharashtra SDL (14/10/2025) | 0.03% | SOV |

| 9.50% GUJARAT 11SEP2023 SDL | 0.03% | SOV |

| 9.50% HARYANA 11SEP2023 SDL | 0.03% | SOV |

| MAHARASHTRA 09.60% 14AUG23 SDL | 0.03% | SOV |

| 6.83% RAJASTHAN SDL 25SEP23 | 0.03% | SOV |

| 6.9% TAMIL NADU SDL 16OCT25 | 0.03% | SOV |

| 6.92% RAJASTHAN 04SEP25 SDL | 0.02% | SOV |

| 6.87% RAJASTHAN 08SEP2031 SDL | 0.02% | SOV |

| 8.27% TAMILNADU 23DEC2025 SDL | 0.02% | SOV |

| 6.91% RAJASTHAN 01SEP2031 SDL | 0.00% | SOV |

| 6.97% MAHARASHTRA 18FEB2028 SDL | 0.00% | SOV |

| TREASURY BILLS | 1.38% | |

| Government of India | 1.38% | SOV |

| SECURITISED DEBT | 0.97% | |

| First Business Receivables Trust | 0.43% | IND AAA(SO) |

| First Business Receivables Trust | 0.41% | IND AAA(SO) |

| First Business Receivables Trust | 0.14% | IND AAA(SO) |

| Securitised Debt Amort | 0.34% | |

| First Business Receivables Trust | 0.19% | CRISIL AAA(SO) |

| First Business Receivables Trust | 0.10% | CRISIL AAA(SO) |

| First Business Receivables Trust | 0.06% | CRISIL AAA(SO) |

| Cash Management Bills | 0.21% | |

| Government of India | 0.06% | SOV |

| Government of India | 0.05% | SOV |

| Government of India | 0.02% | SOV |

| Government of India | 0.02% | SOV |

| Government of India | 0.02% | SOV |

| Government of India | 0.02% | SOV |

| Government of India | 0.02% | SOV |

| Interest Rate Swaps | -0.03% | |

| Clearing Corporation of India Limited | 0.01% | |

| Clearing Corporation of India Limited | 0.01% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Standard Chartered Bank | 0.00% | |

| HSBC Bank | -0.00% | |

| HSBC Bank | -0.00% | |

| HSBC Bank | -0.00% | |

| Clearing Corporation of India Limited | -0.00% | |

| Clearing Corporation of India Limited | -0.00% | |

| Clearing Corporation of India Limited | -0.00% | |

| Clearing Corporation of India Limited | -0.00% | |

| Clearing Corporation of India Limited | -0.00% | |

| Clearing Corporation of India Limited | -0.00% | |

| Clearing Corporation of India Limited | -0.00% | |

| Clearing Corporation of India Limited | -0.00% | |

| Clearing Corporation of India Limited | -0.00% | |

| Clearing Corporation of India Limited | -0.00% | |

| Clearing Corporation of India Limited | -0.00% | |

| ICICI Securities Primary Dealership Limited | -0.00% | |

| Standard Chartered Bank | -0.00% | |

| Clearing Corporation of India Limited | -0.00% | |

| Clearing Corporation of India Limited | -0.00% | |

| ICICI Securities Primary Dealership Limited | -0.00% | |

| ICICI Bank Limited | -0.00% | |

| HSBC Bank | -0.00% | |

| Standard Chartered Bank | -0.00% | |

| IDFC First Bank Limited | -0.00% | |

| Clearing Corporation of India Limited | -0.00% | |

| Clearing Corporation of India Limited | -0.00% | |

| Clearing Corporation of India Limited | -0.00% | |

| BNP Paribas - Indian branches | -0.00% | |

| Standard Chartered Bank | -0.00% | |

| Standard Chartered Bank | -0.00% | |

| Clearing Corporation of India Limited | -0.00% | |

| HSBC Bank | -0.00% | |

| BNP Paribas - Indian branches | -0.00% | |

| IDFC First Bank Limited | -0.00% | |

| Standard Chartered Bank | -0.00% | |

| HSBC Bank | -0.00% | |

| BNP Paribas - Indian branches | -0.00% | |

| BNP Paribas - Indian branches | -0.00% | |

| Standard Chartered Bank | -0.00% | |

| BNP Paribas - Indian branches | -0.00% | |

| BNP Paribas - Indian branches | -0.00% | |

| BNP Paribas - Indian branches | -0.00% | |

| Standard Chartered Bank | -0.00% | |

| BNP Paribas - Indian branches | -0.00% | |

| BNP Paribas - Indian branches | -0.00% | |

| BNP Paribas - Indian branches | -0.00% | |

| Standard Chartered Bank | -0.00% | |

| BNP Paribas - Indian branches | -0.01% | |

| Standard Chartered Bank | -0.01% | |

| HSBC Bank | -0.01% | |

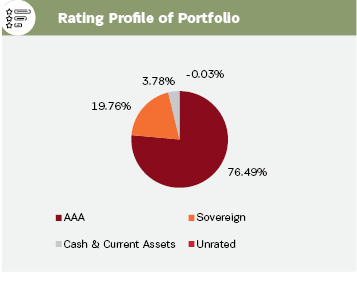

| Cash & Current Assets | 3.78% | |

| Total Net Assets | 100.00% |

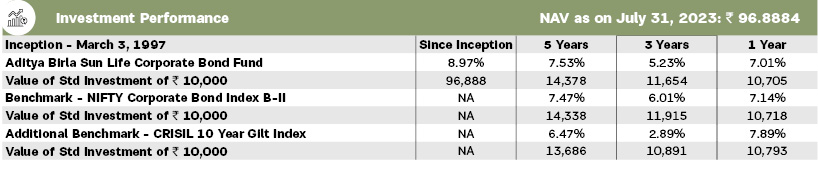

Past performance may or may not be sustained in future. The above performance is of Regular Plan - Growth Option. Kindly note that different plans have different expense structure. Load and Taxes are not considered for computation of returns. When scheme/additional benchmark returns are not available, they have not been shown. Total Schemes Co-Managed by Fund Managers is 1. Total Schemes managed by Mr. Kaustubh Gupta is 10. Total Schemes managed by Mr. Dhaval Joshi is 45. Click here to know more on performance of schemes managed by Fund Managers.

Note: The exit load (if any) rate levied at the time of redemption/switch-out of units will be the rate prevailing at the time of allotment of the corresponding units. Customers may request for a separate Exit Load Applicability Report by calling our toll free numbers 1800-270-7000 or from any of our Investor Service Centers.