Aditya Birla Sun Life CRISIL IBX AAA Mar 2024 Index Fund |

|

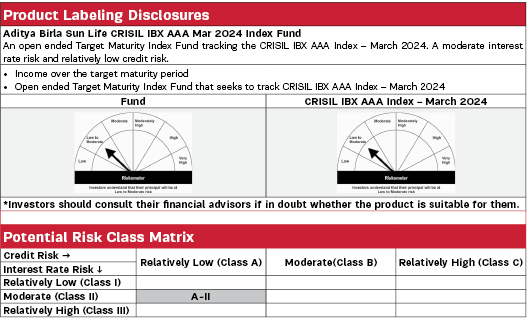

| An open ended Target Maturity Index Fund tracking the CRISIL IBX AAA Index – March 2024. A moderate interest rate risk and relatively low credit risk. |

| Data as on 31st July 2023 |

|

Fund Details |

|

Investment Objective |

|

| The investment objective of the Scheme is to generate returns corresponding to the total returns of the securities as represented by the CRISIL IBX AAA Index – March 2024 before expenses, subject to tracking errors. The Scheme does not guarantee/indicate any returns. There can be no assurance or guarantee that the investment objective of the Scheme will be achieved. | |

|

| Fund Manager | |

|---|---|

| Mr. Mohit Sharma & Mr. Sanjay Godambe |

| Managing Fund Since | |

|---|---|

| February 03, 2023 |

| Experience in Managing the Fund | |

|---|---|

| 0.5 Years |

| Load Structure (as % of NAV) (Incl. for SIP) | |

|---|---|

| Entry Load | Nil |

| Exit Load | Nil |

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 0.32% |

| Direct | 0.11% |

| Including additional expenses and goods and service tax on management fees. | |

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 906.40 Crores |

| AUM as on last day | 940.88 Crores |

| Date of Allotment | |

|---|---|

| February 03, 2023 |

| Benchmark | |

|---|---|

| CRISIL IBX AAA Mar 2024 Index |

| Other Parameters | |

|---|---|

| Modified Duration | 0.56 years |

| Average Maturity | 0.58 years |

| Yield to Maturity | 7.28% |

| Macaulay Duration | 0.58 years |

| Standard deviation of daily tracking difference computed for a 1 year horizon. If the fund is non-existent for 1 year then since inception returns are considered. | |

|

|

||

|---|---|---|

Regular Plan |

Direct Plan |

|

| Growth | 10.3773 |

10.3880 |

| IDCW$: | 10.3773 |

10.3880 |

| $Income Distribution cum capital withdrawal | ||

| Application Amount for fresh subscription | |

|---|---|

| ₹ 500 (plus in multiplies of ₹ 1) |

| Min. Addl. Investment | |

|---|---|

| ₹ 500 (plus in multiplies of ₹ 1) |

| SIP | |

|---|---|

| Monthly: Minimum ₹ 500/- |

| Tracking Error | |

|---|---|

| Regular | 0.17% |

| Direct | 0.17% |

|

PORTFOLIO |

|

| Issuer | % to Net Assets |

Rating |

| Fixed rates bonds - Corporate | 58.33% | |

| Oil & Natural Gas Corporation Limited | 12.58% | ICRA AAA |

| Pipeline Infrastructure Limited | 10.74% | CRISIL AAA |

| National Bank For Agriculture and Rural Development | 6.31% | ICRA AAA |

| National Bank For Agriculture and Rural Development | 5.79% | CRISIL AAA |

| Small Industries Development Bank of India | 4.93% | CARE AAA |

| Bajaj Finance Limited | 2.67% | CRISIL AAA |

| HDFC Bank Limited | 2.65% | ICRA AAA |

| Bajaj Housing Finance Limited | 2.63% | CRISIL AAA |

| Bajaj Finance Limited | 2.63% | CRISIL AAA |

| Kotak Mahindra Prime Limited | 2.63% | CRISIL AAA |

| HDB Financial Services Limited | 2.63% | CRISIL AAA |

| Indian Railway Finance Corporation Limited | 1.60% | CRISIL AAA |

| National Housing Bank | 0.53% | CRISIL AAA |

| Money Market Instruments | 39.94% | |

| Axis Bank Limited | 6.09% | ICRA A1+ |

| Export Import Bank of India | 3.66% | ICRA A1+ |

| Issuer | % to Net Assets |

Rating |

| Small Industries Development Bank of India | 3.58% | CRISIL A1+ |

| Export Import Bank of India | 3.56% | ICRA A1+ |

| ICICI Bank Limited | 3.55% | ICRA A1+ |

| Small Industries Development Bank of India | 3.55% | CRISIL A1+ |

| ICICI Bank Limited | 3.30% | ICRA A1+ |

| Housing Development Finance Corporation Limited | 2.56% | ICRA A1+ |

| Bajaj Finance Limited | 2.55% | ICRA A1+ |

| Housing Development Finance Corporation Limited | 2.54% | ICRA A1+ |

| HDFC Bank Limited | 2.05% | CARE A1+ |

| Housing Development Finance Corporation Limited | 1.42% | ICRA A1+ |

| Axis Bank Limited | 1.02% | ICRA A1+ |

| Housing Development Finance Corporation Limited | 0.51% | ICRA A1+ |

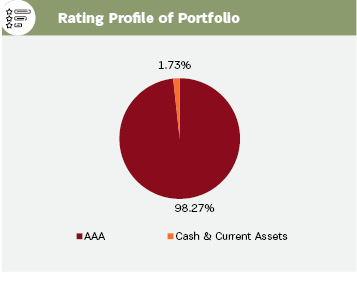

| Cash & Current Assets | 1.73% | |

| Total Net Assets | 100.00% |