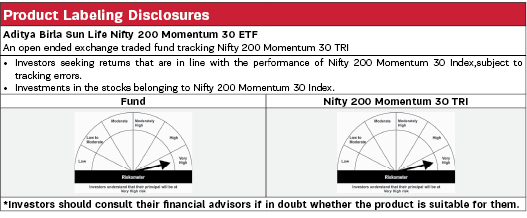

Aditya Birla Sun Life Nifty 200 Momentum 30 ETF |

|

| An open ended exchange traded fund tracking Nifty 200 Momentum 30 TRI BSE Scrip Code: 543575 | Symbol: MOMENTUM |

| Data as on 31st July 2023 |

|

Fund Details |

|

Investment Objective |

|

| The investment objective of the Scheme is to generate returns that are in line with the performance of Nifty 200 Momentum 30 Index, subject to tracking errors. The Scheme does not guarantee/indicate any returns. There can be no assurance that the objective of the Scheme will be achieved. | |

|

| Fund Manager | |

|---|---|

| Mr. Haresh Mehta & Mr. Pranav Gupta |

| Managing Fund Since | |

|---|---|

| March 31, 2023 & August 12, 2022 |

| Experience in Managing the Fund | |

|---|---|

| 0.3 Years & 1.0 Years |

| Load Structure (as % of NAV) (Incl. for SIP) | |

|---|---|

| Entry Load | Nil |

| Exit Load | Nil |

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 0.33% |

| Including additional expenses and goods and service tax on management fees. | |

| Tracking Error | |

|---|---|

| Regular | 0.04% |

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 11.53 Crores |

| AUM as on last day | 12.56 Crores |

| Date of Allotment | |

|---|---|

| August 12, 2022 |

| Benchmark | |

|---|---|

| Nifty 200 Momentum 30 TRI |

| Minimum Application Amount: | |

|---|---|

| For Transactions Directly with the Fund: | |

| For Market Makers: | The Creation Unit size shall be 87,000 units and in multiples thereof. |

| For Large Investors: | Min. application amount shall be Rs. 25 Crores and in multiples of Creation Unit Size |

| For Transactions on Stock Exchanges: | |

|---|---|

| Units of ETF scheme can be traded (in lots of 1 Unit) during the trading hours on all trading days on NSE and BSE on which the Units are listed. |

|

|

|---|

| 22.3375 |

|

PORTFOLIO |

|

| Issuer | % to Net Assets |

Rating |

| Finance | 16.25% | |

| Cholamandalam Investment and Finance Company Limited | 4.85% | |

| Power Finance Corporation Limited | 4.56% | |

| REC Limited | 3.63% | |

| Mahindra & Mahindra Financial Services Limited | 2.02% | |

| Aditya Birla Capital Limited | 1.19% | |

| Banks | 14.16% | |

| Axis Bank Limited | 4.58% | |

| Bank of Baroda | 4.18% | |

| IDFC First Bank Limited | 3.92% | |

| Punjab National Bank | 1.47% | |

| Automobiles | 9.98% | |

| Bajaj Auto Limited | 5.09% | |

| TVS Motor Company Limited | 4.88% | |

| Industrial Products | 9.63% | |

| Cummins India Limited | 4.07% | |

| POLYCAB INDIA Limited | 2.97% | |

| Astral Limited | 2.59% | |

| Electrical Equipment | 8.57% | |

| Siemens Limited | 4.74% | |

| ABB India Limited | 3.83% | |

| Aerospace & Defense | 7.88% | |

| Hindustan Aeronautics Limited | 3.99% | |

| Bharat Electronics Limited | 3.88% |

| Issuer | % to Net Assets |

Rating |

| Pharmaceuticals & Biotechnology | 6.45% | |

| Aurobindo Pharma Limited | 2.69% | |

| Torrent Pharmaceuticals Limited | 1.92% | |

| Zydus Lifesciences Limited | 1.84% | |

| Diversified FMCG | 4.82% | |

| ITC Limited | 4.82% | |

| Leisure Services | 4.60% | |

| The Indian Hotels Company Limited | 4.60% | |

| Personal Products | 4.58% | |

| Godrej Consumer Products Limited | 4.58% | |

| Transport Services | 3.29% | |

| InterGlobe Aviation Limited | 3.29% | |

| Retailing | 3.01% | |

| Trent Limited | 3.01% | |

| Cement & Cement Products | 2.92% | |

| Dalmia Bharat Limited | 1.63% | |

| The Ramco Cements Limited | 1.30% | |

| Auto Components | 1.95% | |

| Apollo Tyres Limited | 1.95% | |

| Healthcare Services | 1.41% | |

| Syngene International Limited | 1.41% | |

| Cash & Current Assets | 0.51% | |

| Total Net Assets | 100.00% |

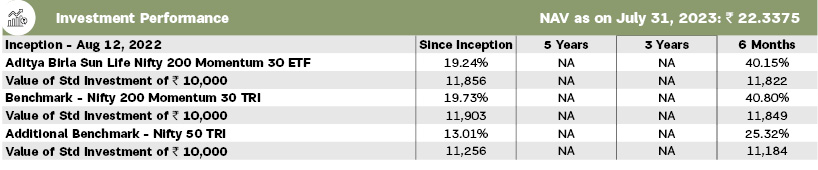

Past performance may or may not be sustained in future. The above performance is of Regular Plan - Growth Option. Kindly note that different plans have different expense structure. Load and Taxes are not considered for computation of returns. When scheme/additional benchmark returns are not available, they have not been shown. Total Schemes Co-Managed by Fund Managers is 15. Total Schemes managed by Mr. Haresh Mehta is 16. Total Schemes managed by Mr. Pranav Gupta is 17. Click here to know more on performance of schemes managed by Fund Managers.

Standard deviation of daily tracking difference computed for a 1 year horizon. If the fund is non-existent for 1 year then since inception returns are considered.

Simple annualized returns have been provided since scheme has completed more than 6 months but less than 1 year.

Note: The exit load (if any) rate levied at the time of redemption/switch-out of units will be the rate prevailing at the time of allotment of the corresponding units. Customers may request for a separate Exit Load Applicability Report by calling our toll free numbers 1800-270-7000 or from any of our Investor Service Centers.