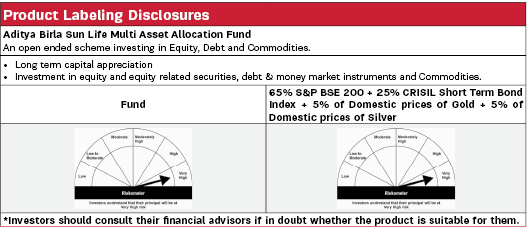

Aditya Birla Sun Life Multi Asset Allocation Fund |

|

| An open ended scheme investing in Equity, Debt and Commodities. |

| Data as on 31st July 2023 |

|

Fund Details |

|

Investment Objective |

|

| The investment objective of the Scheme is to provide long term capital appreciation by investing across asset classes like Equity, Debt, Commodities, & units of REITs & InvITs. The Scheme does not guarantee/indicate any returns. There can be no assurance that the objective of the Scheme will be achieved. | |

Fund Category |

Investment Style |

||

| Hybrid – Multi Asset Allocation |  |

||

| Fund Manager | |

|---|---|

| Mr. Dhaval Shah, Mr. Bhupesh Bameta, Mr. Sachin Wankhede & Mr. Dhaval Joshi |

| Managing Fund Since | |

|---|---|

| January 31, 2023 |

| Experience in Managing the Fund | |

|---|---|

| 0.5 Years |

| Load Structure (as % of NAV) (Incl. for SIP) | |

|---|---|

| Entry Load | Nil |

| Exit Load | For redemption/switch-out of units on or before 365 days from the date of allotment: 1.00% of applicable NAV. For redemption/switch-out of units after 365 days from the date of allotment: Nil. |

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 1.95% |

| Direct | 0.32% |

| Including additional expenses and goods and service tax on management fees. | |

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 2304.12 Crores |

| AUM as on last day | 2433.82 Crores |

| Date of Allotment | |

|---|---|

| January 31, 2023 |

| Benchmark | |

|---|---|

| 65% S&P BSE 200 + 25% CRISIL Short Term Bond Index + 5% of Domestic prices of Gold + 5% of Domestic prices of Silver |

| Other Parameters | |

|---|---|

| Modified Duration | 1.75 years |

| Average Maturity | 2.09 years |

| Yield to Maturity | 7.19% |

| Macaulay Duration | 1.87 years |

| Application Amount for fresh subscription | |

|---|---|

| ₹ 500 (plus in multiplies of ₹ 1) |

| Min. Addl. Investment | |

|---|---|

| ₹ 500 (plus in multiplies of ₹ 1) |

| SIP | |

|---|---|

| Monthly: Minimum ₹ 500/- |

|

|

||

|---|---|---|

| Regular Plan | Direct Plan | |

| Growth | 11.1128 | 11.2060 |

| IDCW$: | 11.1132 | 11.2054 |

| $Income Distribution cum capital withdrawal | ||

|

PORTFOLIO |

|

| Issuer | % to Net Assets |

Rating |

| Banks | 18.04% | |

| HDFC Bank Limited | 7.16% | |

| ICICI Bank Limited | 3.62% | |

| State Bank of India | 1.57% | |

| RBL Bank Limited | 1.26% | |

| Axis Bank Limited | 1.21% | |

| IndusInd Bank Limited | 1.14% | |

| Bank of Baroda | 1.13% | |

| The Federal Bank Limited | 0.89% | |

| Utkarsh Small Finance Bank Ltd | 0.05% | |

| Exchange Traded Fund | 13.77% | |

| Aditya Birla Sun Life Gold ETF | 11.34% | |

| ADITYA BIRLA SUN LIFE SILVER ETF | 2.43% | |

| Fixed rates bonds - Corporate | 12.08% | |

| LIC Housing Finance Limited | 1.44% | CRISIL AAA |

| Sikka Ports and Terminals Limited | 1.03% | CRISIL AAA |

| Fullerton India Credit Company Limited | 1.03% | CRISIL AAA |

| National Bank For Agriculture and Rural Development | 1.03% | CRISIL AAA |

| REC Limited | 1.03% | ICRA AAA |

| Power Finance Corporation Limited | 1.02% | ICRA AAA |

| Small Industries Development Bank of India | 1.02% | ICRA AAA |

| REC Limited | 0.62% | ICRA AAA |

| Power Finance Corporation Limited | 0.62% | ICRA AAA |

| National Bank For Agriculture and Rural Development | 0.61% | ICRA AAA |

| Small Industries Development Bank of India | 0.61% | CRISIL AAA |

| National Bank For Agriculture and Rural Development | 0.61% | ICRA AAA |

| HDFC Bank Limited | 0.61% | ICRA AAA |

| State Bank of India - Tier II - Basel III | 0.59% | ICRA AAA |

| LIC Housing Finance Limited | 0.21% | CRISIL AAA |

| Finance | 5.70% | |

| Poonawalla Fincorp Limited | 1.61% | |

| Bajaj Finance Limited | 1.59% | |

| Cholamandalam Investment and Finance Company Limited | 1.30% | |

| SBI Cards & Payment Services Limited | 1.01% | |

| Jio Financial Services Limited | 0.20% | |

| IT - Software | 4.41% | |

| Infosys Limited | 3.40% | |

| Coforge Limited | 1.01% | |

| Pharmaceuticals & Biotechnology | 3.09% | |

| Cipla Limited | 1.26% | |

| Sun Pharmaceutical Industries Limited | 1.05% | |

| Biocon Limited | 0.79% | |

| Cement & Cement Products | 3.04% | |

| ACC Limited | 1.21% | |

| UltraTech Cement Limited | 1.04% | |

| JK Cement Limited | 0.79% | |

| Diversified FMCG | 2.98% | |

| ITC Limited | 1.61% | |

| Hindustan Unilever Limited | 1.36% | |

| Industrial Products | 2.29% | |

| TIMKEN INDIA LTD | 1.44% | |

| POLYCAB INDIA Limited | 0.85% |

| Issuer | % to Net Assets |

Rating |

| Automobiles | 2.25% | |

| Mahindra & Mahindra Limited | 1.29% | |

| Tata Motors Limited | 0.95% | |

| Healthcare Services | 1.95% | |

| Apollo Hospitals Enterprise Limited | 1.01% | |

| Syngene International Limited | 0.94% | |

| Insurance | 1.95% | |

| HDFC Life Insurance Company Limited | 1.04% | |

| Star Health & Allied Insurance Limited | 0.91% | |

| Petroleum Products | 1.92% | |

| Reliance Industries Limited | 1.92% | |

| Consumer Durables | 1.88% | |

| Dixon Technologies (India) Limited | 1.12% | |

| Orient Electric Ltd. | 0.76% | |

| Beverages | 1.77% | |

| United Spirits Limited | 1.77% | |

| Construction | 1.66% | |

| Larsen & Toubro Limited | 1.66% | |

| Leisure Services | 1.60% | |

| Jubilant Foodworks Limited | 1.04% | |

| The Indian Hotels Company Limited | 0.56% | |

| Power | 1.58% | |

| NTPC Limited | 1.17% | |

| India Grid Trust | 0.41% | |

| Telecom - Services | 1.53% | |

| Bharti Airtel Limited | 1.53% | |

| Electrical Equipment | 1.33% | |

| TD Power Systems Ltd | 1.33% | |

| Government Bond | 1.18% | |

| 5.74% GOI 15NOV2026 | 0.79% | SOV |

| 5.63% GOI 12APR2026 | 0.40% | SOV |

| Retailing | 1.12% | |

| Shoppers Stop Limited | 1.12% | |

| Agricultural Commercial & Construction Vehicles | 1.11% | |

| Ashok Leyland Limited | 1.11% | |

| Ferrous Metals | 1.08% | |

| Tata Steel Limited | 1.08% | |

| Realty | 1.06% | |

| Brigade Enterprises Limited | 1.06% | |

| Money Market Instruments | 0.99% | |

| Housing Development Finance Corporation Limited | 0.99% | ICRA A1+ |

| IT - Services | 0.93% | |

| Cyient Limited | 0.93% | |

| Auto Components | 0.67% | |

| Sona BLW Precision Forgings Limited | 0.67% | |

| Chemicals & Petrochemicals | 0.66% | |

| Vinati Organics Limited | 0.66% | |

| Miscellaneous | 0.06% | |

| Netweb Technologies India Ltd | 0.06% | |

| Cash & Current Assets | 6.33% | |

| Total Net Assets | 100.00% |