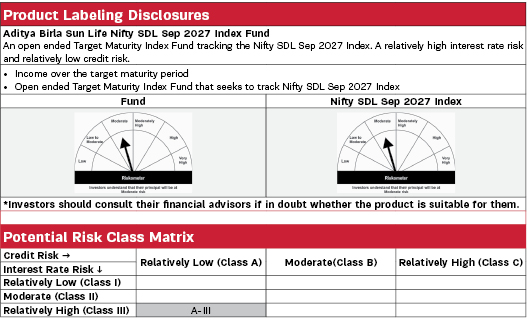

Aditya Birla Sun Life Nifty SDL Sep 2027 Index Fund |

|

| An open ended Target Maturity Index Fund tracking the Nifty SDL Sep 2027 Index. A relatively high interest rate risk and relatively low credit risk. |

| Data as on 31st July 2023 |

|

Fund Details |

|

Investment Objective |

|

| The investment objective of the Scheme is to generate returns corresponding to the total returns of the securities as represented by the Nifty SDL Sep 2027 Index before expenses, subject to tracking errors. The Scheme does not guarantee/indicate any returns. There can be no assurance or guarantee that the investment objective of the Scheme will be achieved. | |

|

| Fund Manager | |

|---|---|

| Mr. Harshil Suvarnkar |

| Managing Fund Since | |

|---|---|

| March 14, 2023 |

| Experience in Managing the Fund | |

|---|---|

| 0.4 Years |

| Load Structure (as % of NAV) (Incl. for SIP) | |

|---|---|

| Entry Load | Nil |

| Exit Load | Nil |

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 0.50% |

| Direct | 0.20% |

| Including additional expenses and goods and service tax on management fees. | |

| Tracking Error | |

|---|---|

| Regular | 1.11% |

| Direct | 1.11% |

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 37.62 Crores |

| AUM as on last day | 37.67 Crores |

| Date of Allotment | |

|---|---|

| March 10, 2023 |

| Benchmark | |

|---|---|

| Nifty SDL Sep 2027 Index |

| Other Parameters | |

|---|---|

| Modified Duration | 3.36 years |

| Average Maturity | 3.93 years |

| Yield to Maturity | 7.39% |

| Macaulay Duration | 3.48 years |

| Standard deviation of daily tracking difference computed for a 1 year horizon. If the fund is non-existent for 1 year then since inception returns are considered. | |

| Application Amount for fresh subscription | |

|---|---|

| ₹ 500 (plus in multiplies of ₹ 1) |

| Min. Addl. Investment | |

|---|---|

| ₹ 500 (plus in multiplies of ₹ 1) |

| SIP | |

|---|---|

| Monthly: Minimum ₹ 500/- |

|

|

||

|---|---|---|

| Regular Plan | Direct Plan | |

| Growth | 10.3593 | 10.3715 |

| IDCW$: | 10.3593 | 10.3715 |

| $Income Distribution cum capital withdrawal | ||

|

PORTFOLIO |

|

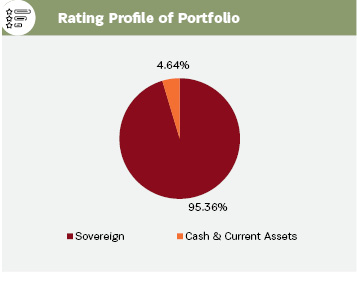

| Issuer | % to Net Assets |

Rating |

| State Government bond | 68.39% | |

| 7.35% MADHYA PRADESH 13SEP2027 SDL | 19.92% | SOV |

| 7.38% TELANGANA 25SEP2027 SDL | 13.28% | SOV |

| 7.23% TAMIL NADU 14JUN2027 SDL | 13.22% | SOV |

| 7.12% TAMIL NADU 09AUG2027 SDL | 13.22% | SOV |

| 7.20% MAHARASHTRA 09AUG2027 SDL | 7.93% | SOV |

| 8.49% ANDHRA PRADESH 21AUG2027 SDL | 0.83% | SOV |

| Issuer | % to Net Assets |

Rating |

| Cash Management Bills | 14.95% | |

| Government of India | 14.95% | SOV |

| Government Bond | 12.03% | |

| 7.38% GOI 20JUN2027 | 12.03% | SOV |

| Cash & Current Assets | 4.64% | |

| Total Net Assets | 100.00% |