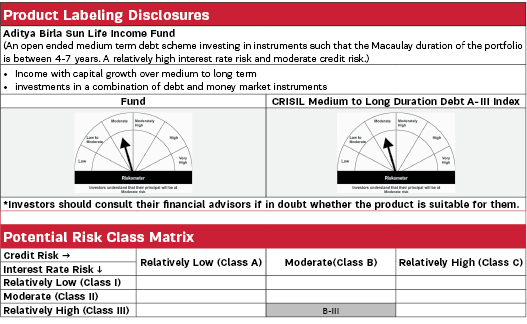

Aditya Birla Sun Life Income Fund |

|

| An open ended medium term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 4-7 years. A relatively high interest rate risk and moderate credit risk.) |

| Data as on 31st July 2023 |

|

Fund Details |

|

Investment Objective |

|

| The objective of the scheme is to generate consistent income through superior yields on its investments at moderate levels of risk through a diversified investment approach. This income may be complemented by price changes of instruments in the portfolio. | |

|

| Fund Manager | |

|---|---|

| Mr. Bhupesh Bameta & Mr. Dhaval Joshi |

| Managing Fund Since | |

|---|---|

| August 06, 2020 & November 21, 2022 |

| Experience in Managing the Fund | |

|---|---|

| 3.0 years & 0.7 Years |

| Load Structure (as % of NAV) (Incl. for SIP) | |

|---|---|

| Entry Load | Nil |

| Exit Load | Nil |

| Total Expense Ratio (TER) | |

|---|---|

| Regular | 0.89% |

| Direct | 0.49% |

| Including additional expenses and goods and service tax on management fees. | |

| AUM ₹ | |

|---|---|

| Monthly Average AUM | 1837.28 Crores |

| AUM as on last day | 1835.52 Crores |

| Date of Allotment | |

|---|---|

| October 21, 1995 |

| Benchmark | |

|---|---|

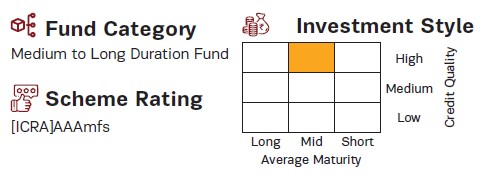

| CRISIL Medium to Long Duration Debt A-III Index |

| Other Parameters | |

|---|---|

| Modified Duration | 4.27 years |

| Average Maturity | 5.72 years |

| Yield to Maturity | 7.41% |

| Macaulay Duration | 4.46 years |

|

|

||

|---|---|---|

Regular Plan |

Direct Plan |

|

| Growth | 108.8690 |

116.4127 |

| Quarterly IDCW$: | 13.2145 |

14.0666 |

| IDCW$: | 12.5897 |

13.3042 |

| $Income Distribution cum capital withdrawal | ||

| Application Amount for fresh subscription | |

|---|---|

| ₹ 5,000 (plus in multiplies of ₹ 1) |

| Min. Addl. Investment | |

|---|---|

| ₹ 1,000 (plus in multiplies of ₹ 1) |

| SIP | |

|---|---|

| Monthly: Minimum ₹ 1,000/- |

|

PORTFOLIO |

|

| Issuer | % to Net Assets |

Rating |

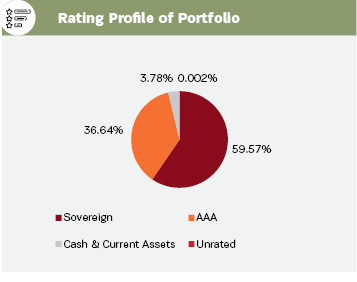

| Government Bond | 49.63% | |

| 7.26% GOVERNMENT OF INDIA 06FEB33 | 28.22% | SOV |

| 7.38% GOI 20JUN2027 | 7.13% | SOV |

| 7.17% GOVERNMENT OF INDIA 18APR30 | 5.85% | SOV |

| 7.10% GOVERNMENT OF INDIA 18APR29 | 4.61% | SOV |

| 5.74% GOI 15NOV2026 | 1.77% | SOV |

| 7.06% GOI 10APR28 | 0.89% | SOV |

| 8.24% GOI (MD 15/02/2027) | 0.56% | SOV |

| 8.15% GOI (MD 24/11/2026) | 0.28% | SOV |

| 7.59% GOI(MD 11/01/2026) | 0.28% | SOV |

| GOI 08.28% 21SEP27 | 0.03% | SOV |

| GOI 07.41% 19DEC2036 | 0.00% | SOV |

| Fixed rates bonds - Corporate | 36.64% | |

| REC Limited | 2.73% | CARE AAA |

| LIC Housing Finance Limited | 2.72% | CRISIL AAA |

| HDFC Bank Limited | 2.72% | ICRA AAA |

| HDB Financial Services Limited | 2.70% | CRISIL AAA |

| Power Finance Corporation Limited | 2.67% | ICRA AAA |

| National Bank For Agriculture and Rural Development | 2.43% | ICRA AAA |

| Sikka Ports and Terminals Limited | 2.13% | CRISIL AAA |

| HDFC Bank Limited | 1.37% | CRISIL AAA |

| LIC Housing Finance Limited | 1.36% | CRISIL AAA |

| LIC Housing Finance Limited | 1.36% | CARE AAA |

| National Bank For Agriculture and Rural Development | 1.36% | CRISIL AAA |

| Small Industries Development Bank of India | 1.36% | CRISIL AAA |

| Bajaj Housing Finance Limited | 1.35% | CRISIL AAA |

| Small Industries Development Bank of India | 1.35% | ICRA AAA |

| HDFC Bank Limited | 1.33% | ICRA AAA |

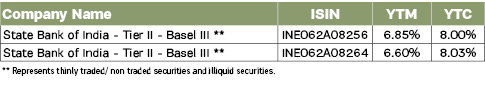

| State Bank of India - Tier II - Basel III | 1.32% | ICRA AAA |

| LIC Housing Finance Limited | 1.10% | CRISIL AAA |

| Small Industries Development Bank of India | 0.92% | CRISIL AAA |

| REC Limited | 0.81% | ICRA AAA |

| National Bank For Agriculture and Rural Development | 0.68% | ICRA AAA |

| LIC Housing Finance Limited | 0.56% | CRISIL AAA |

| LIC Housing Finance Limited | 0.56% | CRISIL AAA |

| Larsen & Toubro Limited | 0.55% | CRISIL AAA |

| State Bank of India - Tier II - Basel III | 0.52% | ICRA AAA |

| Issuer | % to Net Assets |

Rating |

| Power Finance Corporation Limited | 0.27% | ICRA AAA |

| National Bank For Agriculture and Rural Development | 0.26% | ICRA AAA |

| Small Industries Development Bank of India | 0.16% | ICRA AAA |

| Cash Management Bills | 5.39% | |

| Government of India | 3.69% | SOV |

| Government of India | 0.47% | SOV |

| Government of India | 0.45% | SOV |

| Government of India | 0.44% | SOV |

| Government of India | 0.20% | SOV |

| Government of India | 0.14% | SOV |

| Government of India | 0.01% | SOV |

| State Government bond | 4.56% | |

| 7.78% MAHARASHTRA 27OCT2030 SDL | 1.39% | SOV |

| 7.76% MAHARASHTRA 04Oct2030 SDL | 1.11% | SOV |

| 8.08% KARNATAKA 11MAR2025 SDL | 0.33% | SOV |

| 7.79% UTTAR PRADESH 29MAR33 SDL | 0.28% | SOV |

| GUJARAT 8.94% 24SEP24 SDL | 0.28% | SOV |

| 7.56% UTTAR PRADESH 11OCT2027 SDL | 0.27% | SOV |

| 7.14% TAMIL NADU 02MAR2032 SDL | 0.27% | SOV |

| 7.15% MAHARASHTRA 13OCT2026 SDL | 0.11% | SOV |

| 8.67% MAHARASHTRA 24FEB2026 SDL | 0.09% | SOV |

| 7.65% TELANGANA 15APR2030 SDL | 0.06% | SOV |

| 7.65% UTTAR PRADESH 15APR2030 SDL | 0.06% | SOV |

| 8.88% WEST BENGAL 24FEB26 SDL | 0.06% | SOV |

| 8.31% TELANGANA 13JAN2026 SDL | 0.06% | SOV |

| 6.54% MAHARASHTRA 09FEB2027 SDL | 0.05% | SOV |

| 7.81% UTTAR PRADESH 29MAR34 SDL | 0.05% | SOV |

| TAMIL NADU 08.06% 15APR25 SDL | 0.03% | SOV |

| 8.08% MADHYA PRADESH 11FEB2025 SDL | 0.03% | SOV |

| 9.45% Rahasthan SDL (MD 26/03/2024) | 0.02% | SOV |

| 6.72% TAMIL NADU 07OCT2027 SDL | 0.02% | SOV |

| 7.88% Chattisgarh SDL (MD 15/03/2027) | 0.01% | SOV |

| Interest Rate Swaps | 0.00% | |

| Clearing Corporation of India Limited | 0.00% | |

| Cash & Current Assets | 3.78% | |

| Total Net Assets | 100.00% |

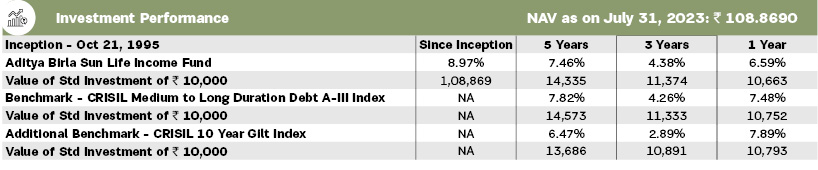

Past performance may or may not be sustained in future. The above performance is of Regular Plan - Growth Option. Kindly note that different plans have different expense structure. Load and Taxes are not considered for computation of returns. When scheme/additional benchmark returns are not available, they have not been shown. Total Schemes Co-Managed by Fund Managers is 2. Total Schemes managed by Mr. Bhupesh Bameta is 11. Total Schemes managed by Mr. Dhaval Joshi is 45. Click here to know more on performance of schemes managed by Fund Managers.

Note: The exit load (if any) rate levied at the time of redemption/switch-out of units will be the rate prevailing at the time of allotment of the corresponding units. Customers may request for a separate Exit Load Applicability Report by calling our toll free numbers 1800-270-7000 or from any of our Investor Service Centers.