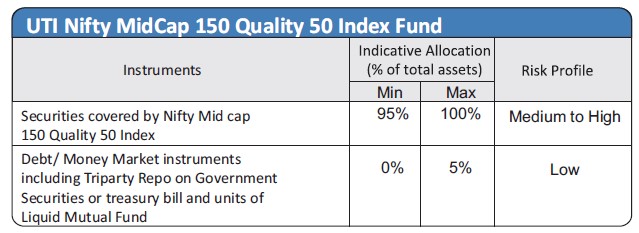

| Investment Objective The investment objective of the scheme is to provide returns that, before expenses, closely correspond to the total returns of the securities as represented by the underlying index, subject to tracking error. However, there is no guarantee or assurance that the investment objective of the scheme will be achieved. |

|

Inception Date |

11th Apr, 2022 |

Fund Manager |

Mr. Sharwan Kumar Goyal, B.Com,CFA, MMS Managing the scheme since April 2022 Mr Ayush Jain, Assistant Fund Manager CA, B.Com (Tax) Managing the scheme since May 2022. |

Fund AUM |

Fund size Monthly average : 170.34 Crore Closing AUM : 174.05 Crore |

High/Low NAV in the month |

High Growth Option : 12.1264 Low Growth Option : 11.8706 |

Total expense ratio (%) |

Regular : 0.91 Direct : 0.46 |

Minimum Investment Amount |

5000/- subsequent minimum investment under a folio is 1000/- and in multiplies of 1/- thereafter with no upper limit |

Plans/Options

(Regular / Direct) |

Growth option |

Load Structure |

Entry Load* : Nil (Not Applicable as per SEBI guidelines) Exit Load : Nil *In terms of provision no. 10.4.1 a. of para 10.4 under Chapter 10 of SEBI Master Circular for Mutual Funds No. SEBI/HO/IMD/IMD-PoD-1/P/CIR/2023/74 dated May 19, 2023 no entry load will be charged by the Scheme to the investor effective August 1, 2009 |

NAV per unit as on 31st January, 2024 |

Regular Growth Option: 12.1264 Direct Growth Option: 12.2287 |

Benchmark Index |

Nifty Midcap 150 Quality 50 TRI |

| SIP/SWP/STRIP | |

| Fund Size | 170.34 Crore (Monthly Average as on 31/1/2024) |

| Information Technology | 17% |

| Capital Goods | 15% |

| Financial Services | 13% |

| Chemicals | 11% |

| Healthcare | 9% |

Equity

|

% of NAV

|

| Power Finance Corporation Ltd. | 4.29 |

| Persistent Systems Ltd. | 3.87 |

| HDFC Asset Management Company Ltd | 3.71 |

| Tube Investments Of India Ltd | 3.38 |

| Page Industries Ltd | 3.34 |

| Tata Elxsi Ltd. | 3.33 |

| Oracle Financial Services Software Ltd. | 2.85 |

| Coforge Ltd | 2.63 |

| Petronet LNG Ltd. | 2.60 |

| NMDC Ltd. | 2.58 |

| Abbott India Ltd. | 2.57 |

| Mphasis Ltd | 2.32 |

| Supreme Industries Ltd. | 2.29 |

| L&T Technology Services Ltd | 2.22 |

| Astral Ltd. | 2.19 |

| Solar Industries India Ltd. | 2.19 |

| Voltas Ltd. | 2.10 |

| Glaxosmithkline Pharmacueticals Ltd. | 2.06 |

| Polycab India Ltd | 2.04 |

| ICICI Securities Ltd. | 2.01 |

| Indraprastha Gas Ltd | 2.00 |

| Grindwell Norton Ltd. | 1.97 |

| AU Small Finance Bank Ltd | 1.97 |

| Coromandel International Ltd. | 1.90 |

| SKF India Ltd. | 1.88 |

| AIA Engineering Ltd. | 1.88 |

| Emami Ltd. | 1.85 |

| Crompton Greaves Consumer Electricals Ltd. | 1.83 |

| APL Apollo Tubes Ltd | 1.75 |

| Balkrishna Industries Ltd. | 1.67 |

| Others | 26.65 |

| Net Current Assets | 0.08 |

TOTAL |

100.00 |

% of top 10 stocks |

32.58 |

Median Market Cap ( Cr) |

41,635

|

Weighted Average Market Cap |

48,338 |

Number of Securities |

50 |

All figures given are provisional and unaudited. As on 31st January, 2024 |

Large |

Mid |

Small |

|

| Fund | 8 |

76 |

16 |

| Fund Performance Vs Benchmark (CAGR) as on 31st January, 2024 Growth of 10000

|

||||||

| Period | NAV (%) |

Nifty Midcap 150 Quality 50 (%) |

Nifty 50 (%) |

NAV () |

Nifty Midcap 150 Quality 50 () |

Nifty 50 () |

| 1 Y | 31.02 |

32.22 |

24.35 |

13,102 |

13,222 |

12,435 |

| SI* | 11.25 |

12.08 |

13.45 |

12,126 |

12,290 |

12,563 |

Different plans have a different expense structure. The performance details provided herein are of regular plan.

*Compounded annualized Growth Rate

For performance details of other Schemes managed by the Fund Manager, please refer the respective Scheme sheets as Please click here in 'Fund Manager Summary'. Schemes Managed by Mr. Shrawan Kumar Goyal & Mr Ayush Jain. The performance of the benchmark is calculated using the total return index variant of the benchmark index. Load is not taken into consideration for computation of performance.

| Period | |||||||

|

Investment Amount ()

|

Value- Fund ()

|

NIFTY Midcap

150 Quality 50 TRI () |

Nifty 50 TRI ()

|

Yield (%) Fund

|

Yield (%) NIFTY Midcap

150 Quality 50 TRI |

Yield (%)

Nifty 50 TRI |

|

1 Y |

120,000 |

142,924 |

143,691 |

138,471 |

37.09 |

38.39 |

29.62 |

SI* |

210,000 |

258,050 |

260,147 |

253,006 |

24.39 |

25.43 |

21.88 |

Note: Systematic Investment Plan (SIP) returns are worked out assuming investment of 10,000/- every month at NAV per unit of the scheme as on the first working day for the respective time periods. The loads have not been taken into account. Past performance may or may not be sustained in future.

*Investors should consult their Mutual Fund Distributor if in doubt about whether the product is suitable for them.

- Capital growth in tune with the index returns

- Passive investment in equity instruments comprised in NIFTY Midcap 150 Quality 50 Index

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.