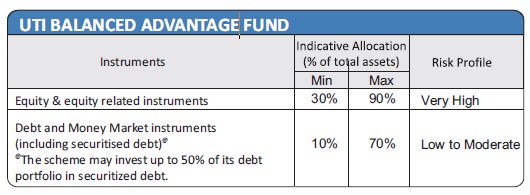

| Investment Objective The scheme intends to provide long-term capital appreciation and income by investing in a dynamically managed portfolio of equity and debt instruments. However, there is no assurance or guarantee that the investment objective of the scheme will be achieved. |

|||||||||

Inception Date |

10th August, 2023 | ||||||||

Fund Manager |

Mr. Sachin Trivedi (Equity Portion) B.Com, MMS, CFA. Managing this scheme since August 2023. Mr. Anurag Mittal (Debt Portion) B.Com, Master of Science, Chartered Accountant. Managing this scheme since August 2023. |

||||||||

Fund AUM |

Fund size monthly average : 2634.99 Crore Closing AUM : 2654.37 Crore |

||||||||

High/Low NAV in the month |

High Growth Option : 10.9235 Low Growth Option : 10.7490 |

||||||||

Total expense ratio (%) |

Regular : 1.90 Direct : 0.45 |

||||||||

Minimum Investment Amount |

Minimum initial investment is Rs. 5,000/- and in multiples of Re.1/- thereafter. | ||||||||

Plans/Options

(Regular / Direct) |

Growth Option IDCW Option with Payout Option |

||||||||

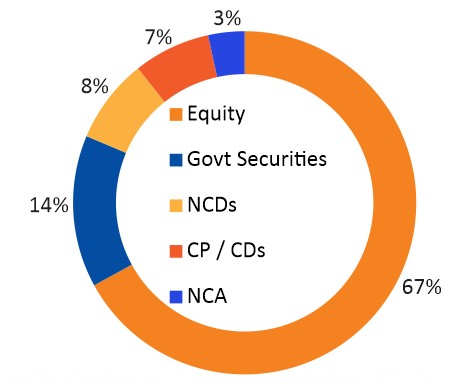

| Market Capitalisation (%) |

|

||||||||

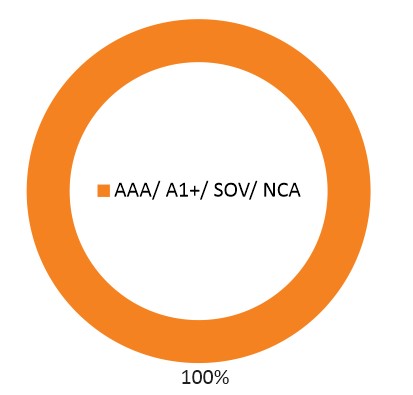

| Portfolio Parameters | Weighted Average Maturity : 2.62 Yrs Yield to Maturity* : 7.38% Modified Duration : 2.23 Yrs Macaulay Duration: 2.23 Yrs *Annualized Portfolio YTM – Yields of all securities are annualized |

||||||||

Load Structure |

Entry Load *: Nil (Not Applicable as per SEBI guidelines) Exit Load: (A) Redemption/ switch out within 12 months from the date of allotment – i) up to 10% of the allotted units – Nil ii) beyond 10% of the allotted Units – 1.00% B) Redemption/ switch out after 12 months from the date of allotment – Nil *In terms of provision no. 10.4.1 a. of para 10.4 under Chapter 10 of SEBI Master Circular for Mutual Funds No. SEBI/HO/IMD/IMD-PoD-1/P/CIR/2023/74 dated May 19, 2023 no entry load will be charged by the Scheme to the investor effective August 1, 2009 |

||||||||

NAV per unit as on 31st January, 2024 |

Regular Growth Option : 10.8581 Regular IDCW Option : 10.8581 Direct Growth Option : 10.9338 Direct IDCW Option : 10.9338 |

||||||||

Benchmark Index |

Nifty 50 Hybrid Composite Debt 50:50 Index | ||||||||

| Financial Services | 30% |

| Information Technology | 14% |

| Automobile and Auto Components | 9% |

| Oil, Gas & Consumable Fuels | 7% |

| Fast Moving Consumer Goods | 6% |

| Portfolio | % of Nav |

Rating |

Futures |

| Equity | |||

| Larsen And Toubro Ltd. | 3.95 |

-0.55 |

|

| NTPC Ltd. | 3.56 |

-0.26 |

|

| Tata Motors Ltd. | 3.21 |

||

| ITC Ltd. | 3.12 |

-0.57 |

|

| Axis Bank Ltd. | 3.04 |

-0.75 |

|

| Coal India Ltd. | 2.41 |

-0.24 |

|

| Oil & Natural Gas Corporation Ltd. | 2.21 |

||

| Bajaj Auto Ltd. | 2.08 |

||

| HDFC Bank Ltd. | 2.05 |

-2.06 |

|

| Hindustan Aeronautics Ltd | 1.77 |

-0.47 |

|

| Lupin Ltd. | 1.74 |

-0.47 |

|

| Trent Ltd. | 1.70 |

||

| Maruti Suzuki India Ltd. | 1.66 |

-0.19 |

|

| Titan Company Ltd. | 1.65 |

||

| Mahindra & Mahindra Ltd. | 1.63 |

-0.18 |

|

| Zomato Ltd | 1.46 |

||

| DLF Ltd. | 1.41 |

||

| Aurobindo Pharma Ltd. | 1.38 |

-0.36 |

|

| Shriram Finance Ltd | 1.24 |

-0.14 |

|

| Indian Oil Corporation Ltd. | 1.22 |

||

| GAIL (India) Ltd. | 1.22 |

-0.29 |

|

| Varun Beverages Ltd | 1.16 |

||

| Cholamandalam Investment And Fin. Co. Ltd | 1.15 |

||

| TVS Motor Company Ltd | 1.14 |

||

| Bharat Electronics Ltd. | 1.09 |

-0.13 |

|

| Polycab India Ltd | 1.07 |

||

| Bharat Forge Ltd. | 1.07 |

-0.41 |

|

| Suzlon Energy Ltd. | 1.06 |

||

| Hero Motocorp Ltd. | 1.06 |

-0.28 |

|

| Birlasoft Ltd | 0.99 |

-0.35 |

|

| Bank Of Baroda | 0.86 |

-0.15 |

|

| CG Power And Industrial Solutions Ltd. | 0.85 |

||

| Canara Bank | 0.84 |

-0.09 |

|

| Zydus Lifesciences Ltd | 0.84 |

-0.33 |

|

| Supreme Industries Ltd. | 0.83 |

||

| Exide Industries Ltd. | 0.81 |

-0.21 |

|

| Sundaram Finance Ltd. | 0.70 |

||

| HDFC Asset Management Company Ltd | 0.70 |

||

| Torrent Pharmaceuticals Ltd. | 0.60 |

-0.07 |

|

| Interglobe Aviation Ltd | 0.58 |

-0.06 |

|

| Petronet LNG Ltd. | 0.57 |

-0.57 |

|

| ICICI Lombard General Insurance Company Ltd | 0.56 |

-0.07 |

|

| Jyothy Labs Ltd. | 0.53 |

||

| Blue Star Ltd. | 0.49 |

||

| NCC Ltd. | 0.46 |

||

| Dalmia Bharat Ltd | 0.46 |

-0.46 |

|

| Cholamandalam Financial Holdings Ltd | 0.41 |

||

| Firstsource Solutions Ltd. | 0.38 |

||

| Federal Bank Ltd. | 0.33 |

-0.33 |

|

| Abbott India Ltd. | 0.31 |

-0.31 |

|

| ABB India Ltd. | 0.18 |

-0.18 |

|

| Aditya Birla Capital Ltd | 0.12 |

-0.12 |

|

| Siemens India Ltd. | 0.10 |

-0.10 |

|

| Cummins India Ltd. | 0.10 |

-0.10 |

|

| Bosch Ltd. | 0.09 |

-0.09 |

|

| Apollo Tyres Ltd. | 0.06 |

-0.06 |

|

| Mahanagar Gas Ltd. | 0.04 |

-0.04 |

|

| Reliance Industries Ltd. | 0.01 |

-0.01 |

|

| Indian Hotels Company Ltd. | 0.00 |

||

| Govt Securities | |||

| 7.41% GS MAT - 19/12/2036 | 4.41 |

SOV |

|

| 07.18% GSEC MAT -24/07/2037 | 4.32 |

SOV |

|

| 6.54% GSEC MAT - 17/01/2032 | 2.09 |

SOV |

|

| 07.18% GSEC MAT -14/08/2033 | 1.30 |

SOV |

|

| 364 DAYS T - BILL- 07/03/2024 | 0.12 |

SOV |

|

| Long Term Debt | |||

| HDB Financial Services Ltd. | 0.86 |

CRISIL AAA/A1+ |

|

| Mutual Fund Units | |||

| UTI MF- Gold Exchange Traded Fund ETF | 19.33 |

||

| Net Current assets | 1.24 |

||

| Total | 100.00 |

||

Median Market Cap ( Cr) |

356,793 |

Weighted Average Market Cap |

542,233 |

Number of Securities |

56 |

All figures given are provisional and unaudited. The above scheme is in existence for less than 1 year. |

|

*Investors should consult their Mutual Fund Distributor if in doubt about whether the product is suitable for them.

- Long term capital appreciation and income

- Investment in a dynamically managed portfolio of equity and debt instruments

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.