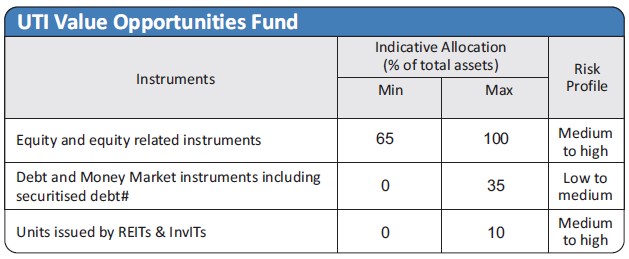

| Investment Objective The primary objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related securities of companies across market capitalization spectrum. However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved. |

|||||||||||||

| Inception Date |

20th August, 2005 | ||||||||||||

| Fund Manager |

Mr Amit Premchandani, PGDM(IIM Indore), CA, CFA, Managing the scheme since Feb-2018 |

||||||||||||

| Fund AUM |

Fund size monthly average : 8406.75 Crore Closing AUM : 8477.99 Crore |

||||||||||||

| High/Low NAV in the month |

High Growth Option : 133.4762 Low Growth Option : 129.2649 |

||||||||||||

Total expense ratio (%) |

Regular : 1.82 Direct : 1.10 |

||||||||||||

Minimum Investment Amount |

Growth, IDCW: 5000/- | ||||||||||||

Plans/Options

(Regular / Direct) |

Growth option IDCW option with Payout and Reinvestment | ||||||||||||

| Market Capitalisation (%) |

|

||||||||||||

Load Structure |

Entry Load : Nil Exit Load (A) Redemption / Switch out within 1 year from the date of allotment – (i) upto 10% of the allotted Units – NIL (ii) beyond 10% of the allotted Units - 1.00 % (B) Redemption / Switch out after 1 year from the date of allotment – NIL |

||||||||||||

NAV per unit as on 31st January, 2024 |

Regular Growth Option 133.0396 Regular IDCW Option 38.7713 Direct Growth Option 144.1554 Direct IDCW Option 47.0143 |

||||||||||||

Benchmark Index |

Nifty 500 TRI | ||||||||||||

SIP/SWP/STRIP |

|||||||||||||

| Fund Size | 8406.75 Cr (Monthly Average as on 31/1/2024) | ||||||||||||

Overweight (Top 5) |

% of Nav |

Underweight (Top 5) |

% of Nav |

| Axis Bank Ltd. | 2.27 |

Reliance Industries Ltd. | -6.16 |

| Bharti Airtel Ltd. | 2.25 |

Larsen And Toubro Ltd. | -2.62 |

| Tech Mahindra Ltd | 2.22 |

ITC Ltd. | -2.50 |

| Hindalco Industries Ltd. | 2.06 |

Tata Consultancy Services Ltd. | -2.47 |

| Mphasis Ltd | 2.01 |

Hindustan Unilever Ltd. | -1.41 |

UTI Value Opportunities Fund (Formerly known as UTI Opportunities) - IDCW Declared |

||||||

Year |

IDCW |

Per unt |

NAV (Cum Div ) |

Face Value (per unit) |

NAV Date |

Record Date |

2007 |

17% |

1.70 |

13.74 |

10.00 |

29-06-2007 |

06-07-2007 |

2008 |

18% |

1.80 |

11.54 |

10.00 |

01-07-2008 |

08-07-2008 |

2009 |

10% |

1.00 |

11.95 |

10.00 |

10-07-2009 |

17-07-2009 |

2010 |

15% |

1.50 |

14.05 |

10.00 |

22-01-2010 |

29-01-2010 |

2011 |

8.00% |

0.80 |

14.97 |

10.00 |

24-04-2011 |

01-05-2011 |

2012 |

9.00% |

0.90 |

14.39 |

10.00 |

12-04-2012 |

19-04-2012 |

2013 |

10.00% |

1.00 |

15.20 |

10.00 |

07-05-2013 |

14-05-2013 |

2014 |

12.50% |

1.25 |

16.0517 |

10.00 |

15-04-2014 |

22-04-2014 |

2015 |

15% |

1.50 |

20.5752 |

10.00 |

16-04-2015 |

17-04-2015 |

2016 |

10% |

1.00 |

18.6083 |

10.00 |

28-04-2016 |

05-05-2016 |

2017 |

13% |

1.30 |

18.6765 |

10.00 |

08-05-2017 |

15-05-2017 |

2018 |

12% |

1.20 |

19.5009 |

10.00 |

02-07-2018 |

09-07-2018 |

2019 |

11% |

1.10 |

18.8335 |

10.00 |

17-07-2019 |

24-07-2019 |

The scheme IDCW details under regular plan.

Disclaimer: Pursuant to payment of Dividend/Bonus, the Nav of the income distribution cum capital withdrawal options of the schemes would fall to the extent of payout and statutory levy (if applicable)

| Financial Services | 32% |

| Information Technology | 12% |

| Healthcare | 8% |

| Automobile and Auto Components | 8% |

| Oil, Gas & Consumable Fuels | 7% |

|

Equity

|

% of NAV

|

| HDFC Bank Ltd. | 8.54 |

| ICICI Bank Ltd | 5.46 |

| Infosys Ltd. | 5.34 |

| Axis Bank Ltd. | 4.16 |

| Bharti Airtel Ltd. | 4.14 |

| State Bank Of India | 3.02 |

| Kotak Mahindra Bank Ltd. | 2.80 |

| Tech Mahindra Ltd | 2.75 |

| Hindalco Industries Ltd. | 2.60 |

| Coal India Ltd. | 2.48 |

| Tata Steel Ltd. | 2.41 |

| Mphasis Ltd | 2.15 |

| Cipla Ltd. | 2.07 |

| Bajaj Auto Ltd. | 2.03 |

| Tata Motors Ltd. | 1.77 |

| Mahindra & Mahindra Ltd. | 1.75 |

| Oil India Ltd. | 1.68 |

| Sun Pharmaceuticals Industries Ltd. | 1.67 |

| Crompton Greaves Consumer Electricals Ltd. | 1.64 |

| IndusInd Bank Ltd. | 1.63 |

| Aditya Birla Fashion And Retail Ltd. | 1.58 |

| CESC Ltd | 1.52 |

| Samvardhana Motherson International Ltd | 1.50 |

| ICICI Lombard General Insurance Company Ltd | 1.50 |

| Eicher Motors Ltd | 1.36 |

| Suven Pharmaceuticals Ltd | 1.33 |

| ICICI Prudential Life Insurance Company Ltd. | 1.31 |

| Bharat Petroleum Corporation Ltd. | 1.30 |

| LTIMindtree Ltd. | 1.29 |

| Mahindra And Mahindra Financial Services Ltd | 1.28 |

| Others | 23.63 |

| Net Current Assets | 2.31 |

TOTAL |

100.00 |

% of top 10 stocks |

41.28 |

Median Market Cap ( Cr) |

133,700

|

Weighted Average Market Cap |

308,109 |

Number of Securities |

55 |

All figures given are provisional and unaudited. |

Quantitative Indicators |

Fund |

Benchmark |

Beta |

0.92 |

1 |

Standard Deviation (Annual) |

13.61% |

14.36% |

Sharpe ratio |

0.96% |

|

| Portfolio Turnover Ratio (Annual) | 0.29 |

|

| P/B | 5.12 |

8.00 |

| P/E | 31.24 |

35.76 |

| RoE | 17.70 |

18.66 |

| Fund Performance Vs Benchmark (CAGR) as on 31st January, 2024 Growth of 10000 |

||||||

| Period | NAV Growth (%) |

Nifty 500 TRI (%) |

Nifty 50 TRI (%) |

NAV Growth () |

Nifty 500 TRI () |

Nifty 50 TRI () |

| 1 Y | 29.93 |

33.81 |

24.35 |

12,993 |

13,381 |

12,435 |

| 3 Y | 19.98 |

21.84 |

18.19 |

17,271 |

18,087 |

16,510 |

| 5 Y | 18.18 |

18.34 |

16.29 |

23,063 |

23,220 |

21,276 |

| SI* | 14.98 |

14.55 |

14.42 |

133,123 |

124,187 |

121,599 |

B - Benchmark, AB - Additional Benchmark, TRI - Total Return Index

Past performance may or may not be sustained in future. Different plans shall have a different expense structure. The performance details provided herein are of regular plan (growth option). Returns greater than 1 year period are Compound Annual Growth Rate (CAGR). Inception of UTI Value Opportunities Fund: May 20, 2005. Date of allotment in the scheme/plan has been considered for inception date. The Scheme is currently managed by Mr. Amit Premchandani since Feb-2018. Period for which scheme's performance has been provided is computed basis last day of the month-end preceding the date of advertisement. In case, the start/end date of the concerned period is a non-business day, the NAV of the previous date is considered for computation of returns. When scheme/additional benchmark returns are not available, they have been shown as N/A. Load is not taken into consideration for computation of performance.

| Period | |||||||

|

Investment Amount ()

|

Value- Fund

() |

Nifty 500 TRI

() |

Nifty 50 TRI ()

|

Yield (%)

Fund |

Yield (%)

Nifty 500 TRI |

Yield (%)

Nifty 50 TRI |

|

1 Y |

120,000 |

143,800 |

146,215 |

138,471 |

38.57 |

42.69 |

29.62 |

3 Y |

360,000 |

479,210 |

488,320 |

459,553 |

19.47 |

20.82 |

16.50 |

5 Y |

600,000 |

1,009,134 |

1,027,778 |

947,510 |

20.91 |

21.66 |

18.32 |

7 Y |

840,000 |

1,572,148 |

1,600,452 |

1,496,823 |

17.58 |

18.08 |

16.20 |

10 Y |

1,200,000 |

2,642,082 |

2,807,351 |

2,594,881 |

15.08 |

16.21 |

14.74 |

15 Y |

1,800,000 |

5,837,207 |

6,165,452 |

5,566,777 |

14.36 |

15.00 |

13.82 |

SI |

2,220,000 |

9,706,291 |

9,498,089 |

8,636,638 |

14.21 |

14.01 |

13.16 |

Note: Systematic Investment Plan (SIP) returns are worked out assuming investment of 10,000/- every month at NAV per unit of the scheme as on the first working day for the respective time periods. The loads have not been taken into account. Past performance may or may not be sustained in future.

*Investors should consult their Mutual Fund Distributor if in doubt about whether the product is suitable for them.:

- Long term capital appreciation

- Investment in equity instruments following a value investment strategy across the market capitalization spectrum

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.