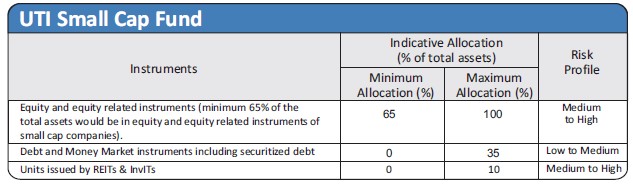

| Investment Objective The objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related securities of small cap companies. However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved. |

|||||||||||||

| Inception Date |

22nd December, 2020 | ||||||||||||

| Fund Manager |

Mr. Ankit Agarwal B.Tech, PGDM (General Management) |

||||||||||||

| Fund AUM |

Fund size monthly average : 3656.75 Crore Closing AUM : 3736.50 Crore |

||||||||||||

| High/Low NAV in the month |

High Growth Option : 21.7090 Low Growth Option : 20.9679 |

||||||||||||

Total expense ratio (%) |

Regular : 1.85 Direct : 0.42 |

||||||||||||

Minimum Investment Amount |

5000/- subsequent minimum investment under a folio is 1000/- and in multiplies of 1/- thereafter with no upper limit | ||||||||||||

Plans/Options

(Regular / Direct) |

IDCW Option with Payout and Reinvestment | ||||||||||||

| Market Capitalisation (%) |

|

||||||||||||

Load Structure |

Entry Load: Nil Exit Load: Less than one year 1% Greater than or equal to one year Nil |

||||||||||||

NAV per unit as on 31st January, 2024 |

Regular Growth Option 21.7090 Regular IDCW Option 21.7088 Direct Growth Option 22.9242 Direct IDCW Option 22.9242 |

||||||||||||

Benchmark Index |

Nifty Small Cap 250 TRI | ||||||||||||

| SIP/SWP/STRIP | |||||||||||||

| Fund Size | 3656.75 Crore (Monthly Average as on 31/1/2024) | ||||||||||||

Overweight (Top 5) |

% of Nav |

Underweight (Top 5) |

% of Nav |

| Techno Electric & Engineering Co Ltd. | 1.84 |

Suzlon Energy Ltd. | -3.11 |

| Chalet Hotels Ltd | 1.82 |

BSE Ltd | -2.06 |

| KPIT Technologies Ltd | 1.81 |

KEI Industries Ltd. | -1.17 |

| Carborandum Universal Ltd. | 1.78 |

Angel One Ltd | -1.10 |

| Persistent Systems Ltd. | 1.73 |

Cyient Ltd | -1.09 |

| Financial Services | 18% |

| Capital Goods | 13% |

| Healthcare | 12% |

| Consumer Durables | 10% |

| Information Technology | 7% |

|

Equity

|

% of NAV

|

| Karur Vysya Bank Ltd. | 2.57 |

| Brigade Enterprises Ltd. | 2.56 |

| Chalet Hotels Ltd | 2.11 |

| Cholamandalam Financial Holdings Ltd | 2.02 |

| Cera Sanitaryware Ltd. | 1.91 |

| Techno Electric & Engineering Co Ltd. | 1.84 |

| 360 One WAM Ltd. | 1.83 |

| KPIT Technologies Ltd | 1.81 |

| Krishna Institute Of Medical Science Ltd | 1.80 |

| Carborandum Universal Ltd. | 1.78 |

| Persistent Systems Ltd. | 1.73 |

| Multi Commodity Exchange Of India Ltd | 1.68 |

| Timken India Ltd. | 1.67 |

| Computer Age Management Services Ltd | 1.58 |

| Firstsource Solutions Ltd. | 1.58 |

| Coforge Ltd | 1.56 |

| Suven Pharmaceuticals Ltd | 1.50 |

| Raymond Ltd. | 1.50 |

| Canfin Homes Ltd. | 1.44 |

| Subros Ltd. | 1.43 |

| J.B.Chemicals & Pharmaceuticals Ltd | 1.43 |

| Ratnamani Metals & Tubes Ltd. | 1.42 |

| CIE Automotive India Ltd | 1.41 |

| Indiamart Intermesh Ltd | 1.40 |

| City Union Bank Ltd | 1.37 |

| Avanti Feeds Ltd | 1.34 |

| Equitas Small Finance Bank Ltd | 1.30 |

| TD Power Systems Ltd. | 1.30 |

| eClerx Services Ltd. | 1.29 |

| Greenpanel Industries Ltd | 1.27 |

| Others | 46.25 |

| Net Current Assets | 4.32 |

TOTAL |

100.00 |

% of top 10 stocks |

20.23 |

Median Market Cap ( Cr) |

14,413 |

Weighted Average Market Cap |

16,478 |

| Number of Securities | 83 |

All figures given are provisional and unaudited. |

|

Fund Performance Vs Benchmark (CAGR) as on 31st January, 2024 Growth of 10000

|

||||||

| Period | NAV Growth (%) |

Nifty Small Cap 250 TRI (%) |

Nifty 50 TRI (%) |

NAV Growth () |

Nifty Small Cap 250 TRI () |

Nifty 50 TRI () |

| 1 Y | 40.99 |

63.75 |

24.35 |

14,099 |

16,375 |

12,435 |

| 3 Y | 29.76 |

36.03 |

18.19 |

21,849 |

25,171 |

16,510 |

| SI* | 28.31 |

37.68 |

17.98 |

21,709 |

27,029 |

16,722 |

B - Benchmark, AB - Additional Benchmark, TRI - Total Return Index

Different plans shall have a different expense structure. The performance details provided herein are of existing plan and growth option. CAGR – Compounded Annualized Growth Rate. The Scheme is currently managed by Mr. Ankit Agarwal since inception. Past performance may or may not be sustained in future. Inception of UTI Small Cap Fund : December 22, 2020. Period for which scheme's performance has been provided is computed basis last day of the month-end preceding the date of advertisement. In case, the start/end date of the concerned period is a non-business day, the NAV of the previous date is considered for computation of returns. Load is not taken into consideration for computation of performance.

| Period | |||||||

Investment Amount () |

Value- Fund () |

Nifty Smallcap 250 TRI () |

Nifty 50 TRI () |

Yield (%) Fund |

Yield (%) Nifty Smallcap 250 TRI |

Yield (%) Nifty 50 TRI |

|

1 Y |

120,000 |

149,915 |

168,451 |

138,471 |

49.06 |

82.09 |

29.62 |

| 3 Y | 360,000 |

523,965 |

592,470 |

459,553 |

25.94 |

35.16 |

16.50 |

| SI | 370,000 |

545,352 |

617,621 |

475,616 |

26.07 |

35.14 |

16.51 |

Note: Systematic Investment Plan (SIP) returns are worked out assuming investment of Rs 10,000/- every month at NAV per unit of the scheme as on the first working day for the respective time periods. The loads have not been taken into account. Past performance may or may not be sustained in future.

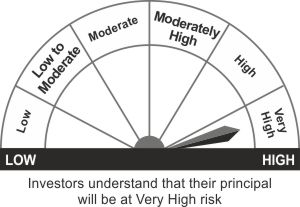

*Investors should consult their Mutual Fund Distributor if in doubt about whether the product is suitable for them.

- Long term capital appreciation

- Investment predominantly equity and equity related securities of small cap companies

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.