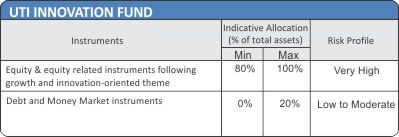

| Investment Objective The scheme intends to provide medium to long-term capital appreciation through investment primarily in growth and innovation-oriented equity and equity-related instruments. |

|||||||||||||

| Inception Date |

13th October, 2023 | ||||||||||||

| Fund Manager |

Mr. Ankit Agarwal, B.Tech, PGDM Managing the scheme since Oct-2023 |

||||||||||||

| Fund AUM |

Fund size monthly average : 579.60 Crore Closing AUM : 613.79 Crore |

||||||||||||

| High/Low NAV in the month |

High Growth Option : 10.9330 Low Growth Option : 10.5390 |

||||||||||||

Total expense ratio (%) |

Regular : 2.37 Direct : 0.96 |

||||||||||||

Plans/Options

(Regular / Direct) |

Growth Option IDCW Option with Payout Option) |

||||||||||||

| Market Capitalisation (%) |

|

||||||||||||

Load Structure |

Nil 1% if redeemed/switched out within 12 months from the date of allotment. Nil thereafter |

||||||||||||

NAV per unit as on 31st January, 2024 |

Regular Growth Option 10.9330 Regular IDCW Option 10.9330 Direct Growth Option 10.9800 Direct IDCW Option 10.9800 |

||||||||||||

Benchmark Index |

Nifty 500 TRI | ||||||||||||

Overweight (Top 5) |

% |

Underweight (Top 5) |

% |

| PB Fintech Ltd | 5.67 |

HDFC Bank Ltd. | -7.01 |

| One 97 Communications Ltd | 5.27 |

Reliance Industries Ltd. | -6.16 |

| Info-Edge (India) Ltd. | 4.67 |

ICICI Bank Ltd | -4.60 |

| Zomato Ltd | 4.51 |

Infosys Ltd. | -3.78 |

| FSN E-Commerce Ventures (Nykaa) Ltd | 4.30 |

Larsen And Toubro Ltd. | -2.62 |

| Information Technology | 28% |

| Consumer Services | 22% |

| Financial Services | 11% |

| Capital Goods | 7% |

| Chemicals | 5% |

|

Equity

|

% of NAV

|

| PB Fintech Ltd | 5.84 |

| One 97 Communications Ltd | 5.40 |

| Zomato Ltd | 4.99 |

| Info-Edge (India) Ltd. | 4.92 |

| FSN E-Commerce Ventures (Nykaa) Ltd | 4.44 |

| L&T Technology Services Ltd | 4.26 |

| Delhivery Ltd. | 4.17 |

| Indiamart Intermesh Ltd | 4.03 |

| Syngene International Ltd. | 4.03 |

| Yatra Online Ltd. | 3.94 |

| Route Mobile Ltd | 3.83 |

| Latent View Analytics Ltd | 3.68 |

| Affle India Ltd | 3.63 |

| Rategain Travel Technologies Ltd | 3.51 |

| Tata Elxsi Ltd. | 3.40 |

| KPIT Technologies Ltd | 3.24 |

| Happiest Minds Technologies Ltd. | 2.95 |

| Nazara Technologies Ltd | 2.90 |

| C.E. Info Systems Ltd | 2.86 |

| Clean Science & Technology Ltd | 2.75 |

| Praj Industries Ltd. | 2.71 |

| P I Industries Ltd. | 2.40 |

| MTAR Technologies Ltd | 2.32 |

| Borosil Renewables Ltd | 2.24 |

| Net Current Assets | 11.55 |

TOTAL |

100.00 |

% of top 10 stocks |

46.02 |

Median Market Cap ( Cr) |

32,223 |

| Weighted Average Market Cap | 34,179 |

Number of Securities |

24 |

All figures given are provisional and unaudited. |

|

Fund |

Benchmark |

|

| P/B | 11.14 |

8.00 |

| P/E | 52.25 |

35.76 |

| ROE | 10.67 |

18.66 |

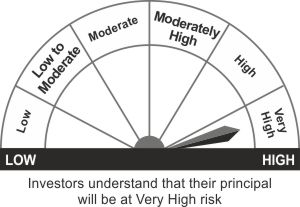

*Investors should consult their Mutual Fund Distributor if in doubt about whether the product is suitable for them.

- Long term capital appreciation

- Investment in equity and equity-related Instruments following innovation theme

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.