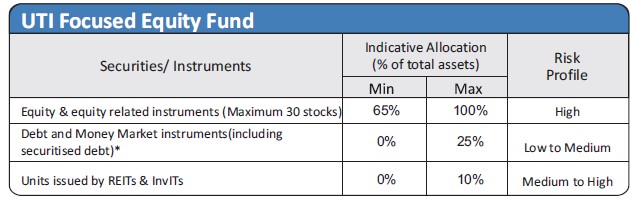

| Investment Objective The investment objective of the scheme is to generate long term capital appreciation by investing in equity & equity related instruments of maximum 30 stocks across market caps. However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved. |

|||||||||||||

| Inception Date |

26th Aug, 2021 | ||||||||||||

| Fund Manager |

Mr. Vishal Chopda, CFA, BE, PGDM Managing the scheme since May 22 |

||||||||||||

| Fund AUM |

Fund size monthly average : 2409.73 Crore Closing AUM : 2390.98 Crore |

||||||||||||

| High/Low NAV in the month |

High Growth Option : 13.3238 Low Growth Option : 12.8318 |

||||||||||||

Total expense ratio (%) |

Regular : 1.97 Direct : 0.57 |

||||||||||||

Minimum Investment Amount |

5000/- subsequent minimum investment under a folio is 1000/- and in multiplies of 1/- thereafter with no upper limit | ||||||||||||

Plans/Options

(Regular / Direct) |

Growth Option IDCW Option with Payout and Reinvestment |

||||||||||||

| Market Capitalisation (%) |

|

||||||||||||

Load Structure |

Entry Load : Nil (Not Applicable as per SEBI guidelines) Exit Load : Less than one year 1% Greater than or equal to one year Nil |

||||||||||||

NAV per unit as on 31st January, 2024 |

Regular Growth Option 12.9905 Regular IDCW Option 12.9906 Direct Growth Option 13.5281 Direct IDCW Option 13.5277 |

||||||||||||

Benchmark Index |

Nifty 500 Index TRI | ||||||||||||

SIP/SWP/STRIP |

|||||||||||||

| Fund Size | 2409.73 Cr (Monthly Average as on 31/1/2024) | ||||||||||||

Overweight (Top 5) |

% |

Underweight (Top 5) |

% |

| Tata Motors Ltd. | 4.10 |

Reliance Industries Ltd. | -6.16 |

| Tata Consultancy Services Ltd. | 4.00 |

Infosys Ltd. | -3.78 |

| ICICI Bank Ltd | 3.97 |

Larsen And Toubro Ltd. | -2.62 |

| IndusInd Bank Ltd. | 3.86 |

ITC Ltd. | -2.50 |

| Godrej Consumer Products Ltd | 3.70 |

Axis Bank Ltd. | -1.89 |

| Financial Services | 31% |

| Automobile and Auto Components | 11% |

| Information Technology | 10% |

| Consumer Services | 10% |

| Fast Moving Consumer Goods | 7% |

Fund |

Benchmark |

|

| Portfolio Turnover | 0.11 |

|

| P/B | 9.06 |

8.00 |

| P/E | 40.37 |

35.76 |

| RoE | 17.96 |

18.66 |

|

Equity

|

% of NAV

|

| ICICI Bank Ltd | 8.57 |

| HDFC Bank Ltd. | 8.26 |

| Tata Consultancy Services Ltd. | 6.46 |

| Tata Motors Ltd. | 5.27 |

| IndusInd Bank Ltd. | 4.51 |

| LTIMindtree Ltd. | 3.99 |

| Godrej Consumer Products Ltd | 3.98 |

| Bharti Airtel Ltd. | 3.92 |

| Bajaj Finance Ltd. | 3.73 |

| Avenue Supermarts Ltd. | 3.66 |

| Trent Ltd. | 3.62 |

| Maruti Suzuki India Ltd. | 3.37 |

| Phoenix Mills Ltd | 3.14 |

| ICICI Lombard General Insurance Company Ltd | 2.83 |

| Ultratech Cement Ltd. | 2.76 |

| Havells India Ltd. | 2.71 |

| Bharat Electronics Ltd. | 2.70 |

| United Breweries Ltd. | 2.68 |

| Cholamandalam Investment And Fin. Co. Ltd | 2.68 |

| Hindalco Industries Ltd. | 2.55 |

| Tube Investments Of India Ltd | 2.48 |

| Bharat Forge Ltd. | 2.45 |

| Jubilant Food Works Ltd | 2.32 |

| Cipla Ltd. | 2.31 |

| Ajanta Pharma Ltd. | 2.04 |

| NTPC Ltd. | 1.93 |

| P I Industries Ltd. | 1.28 |

| Syngene International Ltd. | 1.10 |

| Astral Ltd. | 1.05 |

| Net Current Assets | 1.65 |

TOTAL |

100.00 |

% of top 10 stocks |

52.35 |

Median Market Cap ( Cr) |

220,137 |

| Weighted Average Market Cap | 389,688 |

Number of Securities |

29 |

All figures given are provisional and unaudited. |

| Fund Performance Vs Benchmark (CAGR) as on 31st January, 2024 Growth of 10000 |

||||||

| Period | NAV Growth (%) |

Nifty 500 TRI (%) |

Nifty 50 TRI (%) |

NAV Growth () |

Nifty 500 TRI

() |

Nifty 50 TRI () |

| 1 Y | 29.37 |

33.81 |

24.35 |

12,937 |

13,381 |

12,435 |

| SI* | 11.34 |

16.13 |

12.81 |

12,990 |

14,394 |

13,412 |

B - Benchmark, AB - Additional Benchmark, TRI - Total Return Index

Past performance may or may not be sustained in future. Different plans shall have a different expense structure. The performance details provided herein are of regular plan (growth option). Returns greater than 1 year period are Compound Annual Growth Rate (CAGR). Inception of UTI Focused Equity Fund: Aug 26, 2021. Date of allotment in the scheme/plan has been considered for inception date. The Scheme is currently managed by Mr. Vishal Chopda since May 02, 2022. Period for which scheme's performance has been provided is computed basis last day of the month-end preceding the date of advertisement. In case, the start/end date of the concerned period is a non-business day, the NAV of the previous date is considered for computation of returns. When scheme/additional benchmark returns are not available, they have been shown as N/A.*Assuming all IDCWs were reinvested at the immediate ex-IDCW option NAV. NAVs of IDCW option for the period where growth option was not available and NAVs of growth option thereafter is considered. As TRI values are not available since inception of the scheme, benchmark performance is calculated using composite CAGR of Nifty 500 PRI values from 18-05-1992 to 01-08-2006 and TRI values thereafter. Load is not taken into consideration for computation of performance.

| Period | |||||||

|

Investment Amount ()

|

Value- Fund TRI ()

|

Nifty 500 TRI

() |

Nifty 50 TRI ()

|

Yield (%)

Fund |

Yield (%)

Nifty 500 TRI |

Yield (%)

Nifty 50 TRI |

|

1 Y |

120,000 |

140,094 |

146,215 |

138,471 |

32.33 |

42.69 |

29.62 |

SI |

290,000 |

359,993 |

376,398 |

355,405 |

18.24 |

22.25 |

17.11 |

Note: Systematic Investment Plan (SIP) returns are worked out assuming investment of Rs 10,000/- every month at NAV per unit of the scheme as on the first working day for the respective time periods. The loads have not been taken into account. Past performance may or may not be sustained in future.

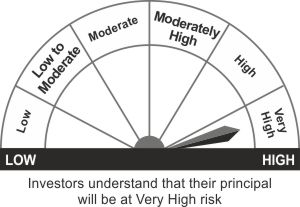

*Investors should consult their Mutual Fund Distributor if in doubt about whether the product is suitable for them.

- Long term capital appreciation

- Investment in equity & equity related securities across market capitalization in maximum 30 stocks

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.