| Investment Objective The investment objective of the scheme is to track the Nifty SDL Plus AAA PSU Bond Apr 2026 75:25 Index by investing in AAA rated PSU Bonds and SDLs, maturing on or before April 2026, subject to tracking errors. However, there is no guarantee or assurance that the investment objective of the scheme will be achieved. |

|

Date of inception/allotment |

10th February, 2023 |

Fund Manager |

Mr. Sunil Patil, M.Com, MFM, CALLB-I |

Fund AUM |

Fund size monthly average :175.50 Crore Closing AUM : 175.92 Crore |

High/Low NAV in the month |

High Growth Option : 10.6833 Low Growth Option : 10.6211 |

Total expense ratio (%) |

Regular : 0.42 Direct : 0.17 |

Minimum Investment Amount |

Minimum amount of investment during NFO and on an ongoing basis under all Plans and Options is Rs 5,000/- and in multiples of Re.1/- thereafter. Subsequent minimum investment amount under a folio is Rs 1,000/- and in multiples of Re 1/- thereafter with no upper limit. |

| Portfolio Parameters | Weighted Average Maturity : 2.09 yrs Yield to Maturity* : 7.60% Modified Duration : 1.82 yrs Macaulay Duration : 1.90 yrs The above scheme is in existence for less than 1 years. *Annualized Portfolio YTM – Yields of all securities are annualized |

Plans/Options

(Regular / Direct) |

Growth Option |

Load Structure |

Entry Load : Nil* (Not Applicable as per SEBI guidelines) Exit Load : Nil *In terms of provision no. 10.4.1 a. of para 10.4 under Chapter 10 of SEBI Master Circular for Mutual Funds No. SEBI/HO/IMD/IMD-PoD-1/P/CIR/2023/74 dated May 19, 2023 no entry load will be charged by the Scheme to the investor effective August 1, 2009 |

NAV per unit as on 31st January, 2024 |

Regular Growth Option: 10.6833 Direct Growth Option: 10.7105 |

Benchmark Index |

NIFTY SDL Plus AAA PSU Bond Apr 2026 75:25 Index |

| SIP/SWP/STRIP | |

| Fund Size | 175.50 Cr (Monthly Average as on 31/1/2024) |

Portfolio |

% of Nav |

Rating |

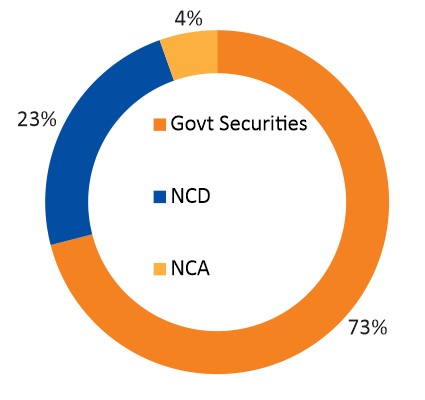

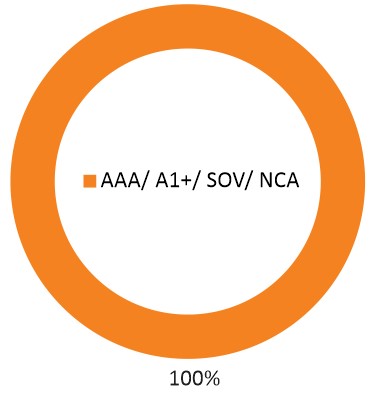

| Govt Securities | ||

| 8.57% WB SDL MAT - 09/03/2026 | 20.91 |

SOV |

| 8.51 MH SDL-09/03/2026 | 15.82 |

SOV |

| 8.53% TN SDL MAT - 09/03/2026 | 12.77 |

SOV |

| 8.28% KA SDL MAT - 06/03/2026 | 11.56 |

SOV |

| 08.65% RAJASTHAN SDL 24/02/2026 | 3.78 |

SOV |

| 8.10% WB SDL 23/03/2026 | 3.25 |

SOV |

| 8.58% UP 2026-09/03/26 | 2.09 |

SOV |

| 8.83% UP SDL 24/02/2026 | 1.75 |

SOV |

| 8.51% HR SDL MAT 10/02/2026 | 0.58 |

SOV |

| NCDs | ||

| 7.60% URNCD REC(SR-219)28/02/2026 | 8.50 |

CRISIL AAA/A1+ |

| 7.57% URNCD NABARD(SR-23G)-19/03/2026 | 7.92 |

CRISIL AAA/A1+ |

| 7.59% URNCD SIDBI SERIES-IX MAT-10/02/2026 | 2.83 |

CRISIL AAA/A1+ |

| 7.23% URNCD SIDBI SERIES-V MAT-09/03/2026 | 2.81 |

ICRA AAA/A1+ |

| 7.11% URNCD SIDBI SERIES-IV MAT-27/02/2026 | 1.35 |

ICRA AAA/A1+ |

| Net Current Assets | 4.08 |

|

Total |

100.00 |

| Fund Performance Vs Benchmark (CAGR) as on 31st January, 2024 Growth of 10000

|

||||||

| Period | NAV Growth (%) |

Nifty SDL Plus AAA PSU Bond Apr 2026 75:25 Index (%) |

CRISIL 10 Year Gilt Index (%) |

NAV Growth () |

Nifty SDL Plus AAA PSU Bond Apr 2026 75:25 Index () |

CRISIL 10 Year Gilt Index () |

| 6 Months | 6.58 |

7.14 |

6.64 |

10,328 |

10,356 |

10,331 |

| SI* | 6.97 |

7.48 |

8.32 |

10,672 |

10,721 |

10,802 |

Different plans have a different expense structure. The performance details provided herein are of regular plan. Returns greater than 6 months but less than one year are Simple Annualized Growth Rate. Period for which scheme's performance has been provided is computed basis last day of the month-end preceding the date of advertisement. In case, the start/end date of the concerned period is a non-business day, the NAV of the previous date is considered for computation of returns. For performance details of other Schemes managed by the Fund Manager, please refer the respective Scheme sheets as listed in page 96 in ‘Fund Manager Summary’. Schemes Managed by Mr. Sunil Patil. Load is not taken into consideration for computation of performance

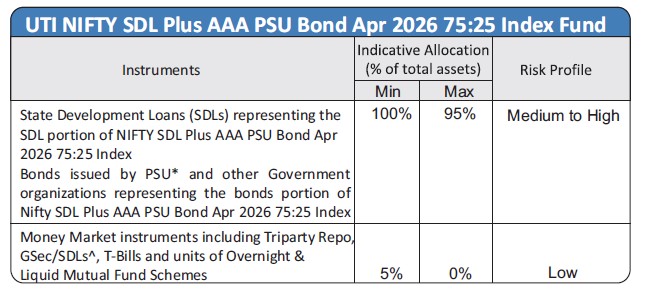

*PSU Bond includes CPSE - Central Public Sector Enterprises; CPSU – Central Public Sector Unit; CPFI – Central Public Financial Institution and bonds issued by other government owned entities.

^ G-sec/SDLs having a residual maturity upto one year.

*Investors should consult their Mutual Fund Distributor if in doubt about whether the product is suitable for them.:

- Income over the target maturity period

Investments in PSU Bonds & State Development Loans (SDLs), tracking Nifty SDL Plus AAA PSU Bond Apr 2026 75:25 Index, subject to tracking error

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.