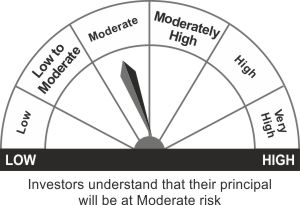

| Investment Objective The investment objective of the scheme is to generate optimal returns with high liquidity by investing in a portfolio of government securities such that weighted average portfolio maturity is around 10 years. However there can be no assurance that the investment objective of the Scheme will be achieved. The Scheme does not guarantee / indicate any returns. |

|

Inception Date |

03rd August, 2022 |

Fund Manager |

Mr. Jaydeep Bhowal & Mr. Anurag Mittal Deputy Head- Fixed Income & Fund Manager: C.A., Msc in Accounting & Finance, London School of Economics, UK Managing the scheme since Aug 2022 |

Fund AUM |

Fund size monthly average :161.83 Crore Closing AUM : 162.75 Crore |

High/Low NAV in the month |

High Growth Option : 11.1087 Low Growth Option : 10.9894 |

Total expense ratio (%) |

Regular : 0.70 Direct : 0.23 |

Minimum Investment Amount |

Minimum amount of investment under all plans and options Minimum initial investment is Rs 5,000/- and in multiples of Rs. 1/- thereafter. Subsequent minimum investment under a folio is Rs. 1,000/- and in multiples of Rs.1/- thereafter with no upper limit. |

| Portfolio Parameters | Weighted Average Maturity :9.91 Years Yield to Maturity* : 7.27% Modified Duration :6.76 yrs Macaulay Duration : 7.00 yrs *Annualized Portfolio YTM – Yields of all securities are annualized |

Plans/Options

(Regular / Direct) |

Growth Option Quarterly IDCW Option/Half Yearly IDCW Option/Annual IDCW Option/Flexi IDCW Option with Payout & Reinvestment facilities |

Load Structure |

Entry Load* :Nil (Not Applicable as per SEBI guidelines) Exit Load :Nil Load Structure during New Fund Offer Period and on an Ongoing basis: *In terms of provision no. 10.4.1 a. of para 10.4 under Chapter 10 of SEBI Master Circular for Mutual Funds No. SEBI/HO/IMD/IMD-PoD-1/P/CIR/2023/74 dated May 19, 2023 no entry load will be charged by the Scheme to the investor effective August 1, 2009 |

NAV per unit as on 31st January, 2024 |

Regular Growth Option11.1087 Regular IDCW Option 11.1083 Direct Growth Option11.1905 Direct IDCW Option 11.1907 |

Benchmark Index |

CRISIL 10 Year Gilt Index |

| SIP/SWP/STRIP | |

| Fund Size | 161.83 Cr (Monthly Average as on 31/1/2024) |

Portfolio |

% of Nav |

Rating |

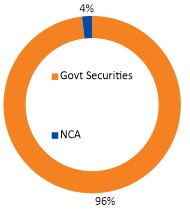

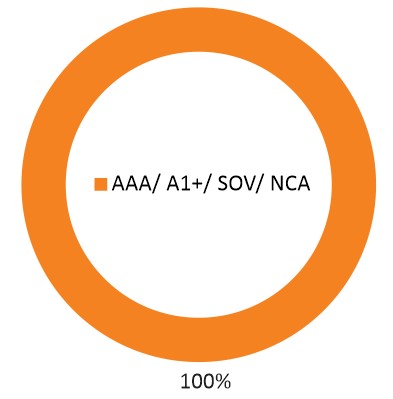

| Govt Securities | ||

| 07.18% GSEC MAT -14/08/2033 | 83.76 |

SOV |

| 07.18% GSEC MAT -24/07/2037 | 12.24 |

SOV |

| Net Current assets | 4.00 |

|

Total |

100.00 |

Fund Performance Vs Benchmark

| Fund Performance Vs Benchmark (CAGR) as on 31st January, 2024 Growth of 10000

|

||||

| Period | NAV Growth (%) |

CRISIL 10 Year Gilt Index (%) |

NAV Growth () |

CRISIL 10 Year Gilt Index () |

| 1 Y | 7.72 |

8.25 |

10,772 |

10,825 |

| SI* | 7.25 |

7.15 |

11,108 |

11,093 |

Different plans have a different expense structure. The performance details provided herein are of regular plan. *Compound annualized Growth Rate. For performance details of other schemes managed by the Fund Manager. Schemes managed by Mr. Jaydeep Bhowal & Mr. Anurag Mittal. Load is not taken into consideration for computation of performance.

| SIP Returns as on 31st January, 2024 | |||||

Investment Amount (Rs) |

Fund Value (Rs) |

Value-Crisil 10 Yr Gilt Index (Rs) |

Yield (%) Fund |

Yield (%) Crisil 10 Yr Gilt Index |

|

| 1 Y | 120,000 |

124,647 |

124,901 |

7.23 |

7.63 |

| SI | 170,000 |

179,257 |

179,823 |

7.28 |

7.72 |

Note: Systematic Investment Plan (SIP) returns are worked out assuming investment of Rs 10,000/- every month at NAV per unit of the scheme as on the first working day for the respective time periods. The loads have not been taken into account. Past performance may or may not be sustained in future.

UTI GILT FUND WITH 10 YEAR CONSTANT DURATION IDCW - Regular Plan |

||||||

Year |

IDCW |

Per unt |

NAV (Cum Div ) |

Face Value (per unit) |

NAV Date |

Record Date |

2023 |

1.75% |

0.175 |

10.3954 |

10.00 |

15-09-2023 |

21-03-2023 |

The scheme IDCW details under regular plan.

Disclaimer: Pursuant to payment of Dividend/Bonus, the Nav of the income distribution cum capital withdrawal options of the schemes would fall to the extent of payout and statutory levy (if applicable)

@@ NAV

of Monthly IDCW Option - Regular Plan

The Scheme IDCW details under regular plan.

*Investors should consult their Mutual Fund Distributor if in doubt about whether the product is suitable for them.:

- Reasonable income over long term

- Investment in government securities having a constant maturity of 10 years

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.