| Fund manager | ||

Mr. Nimesh Chandan (Equity Portion) (Managing fund since inception & Overall experience of 22 years) |

Mr. Nimesh Chandan (Equity Portion) (Managing fund since inception & Overall experience of 15 + years) |

Mr. Nimesh Chandan (Debt Portion) (Managing fund since inception & Overall experience of 17 years) |

To generate long term capital appreciation by investing predominantly in equity and equity related instruments across market capitalisation.

Disclaimer: However, There is no assurance that the investment objective of the Scheme will be achieved.

| Scheme Category | Flexi Cap Fund |

| Benchmark | S&P BSE 500 TRI |

| Additional Benchmark | Not Applicable |

| Plans | Regular Plan and Direct Plan |

| Options | Growth and Income Distribution cum Capital Withdrawal

(IDCW) option with Payout of Income Distribution cum Capital Withdrawal sub-option, Reinvestment of Income Distribution cum Capital Withdrawal sub-option and Transfer of Income Distribution cum Capital Withdrawal sub-option. |

| Date of Allotment | Growth Option: Rs. 5,000 and in multiples of Re. 1 thereafter. Daily IDCW Re-investment Option: Rs. 25,000 and in multiples of Re. 1 thereafter. |

| Minimum Investment Amount | INR 500/- and multiples of INR 1 |

| Minimum Additional Investment Amount | INR 100/- and multiples of INR 1 |

| Entry Load: | NA |

| Entry Load: | If units are redeemed / switched out within 6 months from the

date of allotment:

|

| Regular Plan | 2.08% |

| Direct Plan | 0.79% |

| Month end AUM | 1,669.19 |

| AAUM | 1,621.81 |

| Direct Growth | 10.056 |

| Direct IDCW |

10.056 |

| Regular Growth |

10.028 |

| Regular IDCW | 10.028 |

| (Data as on 31 October, 2023) | |

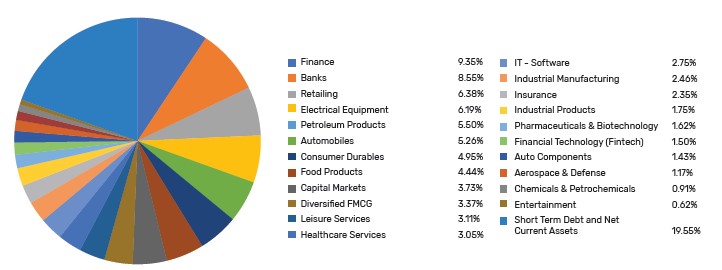

| Stock | % of NAV |

| Reliance Industries Ltd. | 5.50% |

| Bajaj Finance Ltd. | 4.99% |

| ICICI Bank Ltd. | 4.66% |

| Kotak Mahindra Bank Ltd. | 3.89% |

| Nestle India Ltd. | 3.54% |

| Hindustan Unilever Ltd. | 3.37% |

| Infosys Ltd. | 2.75% |

| CreditAccess Grameen Ltd. | 2.73% |

| Mahindra & Mahindra Ltd. | 2.71% |

| Havells India Ltd. | 1.84% |

| Honeywell Automation India Ltd. | 1.75% |

| Avenue Supermarts Ltd. | 1.70% |

| REC Ltd. | 1.63% |

| Sanofi India Ltd. | 1.62% |

| SBI Life Insurance Company Ltd. | 1.56% |

| One 97 Communications Ltd. | 1.50% |

| Hitachi Energy India Ltd. | 1.50% |

| Multi Commodity Exchange of India Ltd. | 1.50% |

| BSE Ltd. | 1.43% |

| Zomato Ltd. | 1.41% |

| Tata Motors Ltd. | 1.28% |

| Eicher Motors Ltd. | 1.27% |

| Jubilant Foodworks Ltd. | 1.22% |

| GE T&D India Ltd. | 1.20% |

| Bharat Electronics Ltd. | 1.17% |

| Dr. Lal Path Labs Ltd. | 1.16% |

| ABB India Ltd. | 1.12% |

| UNO Minda Ltd. | 1.10% |

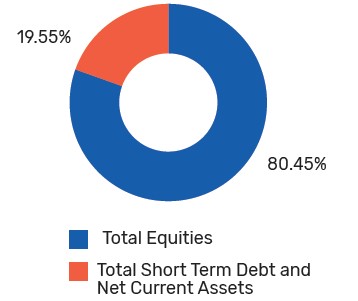

| Total Equities | 80.45% |

| Total Short Term Debt and Net Current Assets | 19.55% |

| Grand Total | 100.00% |

| Bajaj Finserv Flexi Cap Fund This product is suitable for investors who are seeking*:

|

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them |

|

S&P BSE 500 TRI |

|

|

|

|

|

|

|

|

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.