| Investment Objective The Investment Objective of the Scheme is to generate returns that are in line with the performance of physical silver in domestic prices, subject to tracking error. However, there is no guarantee or assurance that the investment objective of the scheme will be achieved. |

||

| Inception Date |

17th April, 2023 | |

| Fund Manager |

Mr. Niranjan Das Postgraduate in Commerce (M. Com), MBA in Finance. Managing the Scheme since April 17,2023 | |

| Fund AUM |

Average AUM for the quarter : ₹ 16.55 Crore ended 31st Dec 2023 Fund Size Monthly Average : ₹ 24.40 Crore Closing AUM : ₹ 56.23 Crore | |

High/Low NAV in the month |

High Growth Option : ₹ 74.5606 Low Growth Option : ₹ 69.5713 |

|

Total expense ratio (%) |

0.53% | |

NAV per unit as on 31st January, 2024 |

₹ 71.6925 | |

| Minimum Application Amount | On the stock exchange: Minimum 1 Unit can be bought/sold in demat form at prevailing prices quoted on the NSE and on any other exchange where they are traded. Direct creation of Units with the Fund: Authorized Participants / others can create the Units in demat form in exchange against prescribed portfolio deposit and the applicable cash component at NAV based prices atleast in one creation unit. |

|

Benchmark Index |

Domestic Price of silver (based on LBMA Silver daily spot fixing price) | |

| Load Structure | Entry Load *: NA Exit Load : Nil *In terms of SEBI circular no. SEBI/IMD/CIR No.4/168230/09 dated June 30, 2009, no entry load will be charged by the Scheme to the investor effective August 1, 2009 |

|

| Silver | 97% | NCA | 3% |

|

Equity

|

% of NAV

|

| Silver Bullion | 96.67 |

| Net Current Assets | 3.33 |

TOTAL |

100.00 |

| Fund Performance Vs Benchmark (CAGR) as on 31st January, 2024 Growth of 10000 |

||||

| Period | NAV Growth (%) |

Domestic price of Silver (%) |

NAV Growth TRI () |

Domestic price of Silver (%) |

| 6 Months | -6.93 |

-6.70 |

9,654 |

9,666 |

| Since inception* | -5.84 |

-5.42 |

9,593 |

9,623 |

The above value is calculated on the basis of the return from Growth Option of the Scheme.

Different plans have a different expense structure. The performance details provided herein are of regular plan.

The current fund manager is managing the scheme since April-2023

*Compounded annualized Growth Rate.

For performance details of other Schemes managed by the Fund Manager, please refer the respective Scheme sheets as listed Please click here in ‘Fund Manager Schemes Managed by Mr. Niranjan Das. The performance of the benchmark is calculated using total return index variant of the benchmark index.

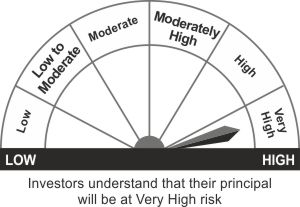

This product is suitable for investors who are seeking*

- Investors seeking returns that are in line with the performance of physical silver over the long term, subject to tracking errors

- Investment predominantly in Physical Silver and Silver related instruments

*Investors should consult their Mutual Fund Distributor if in doubt about whether the product is suitable for them.

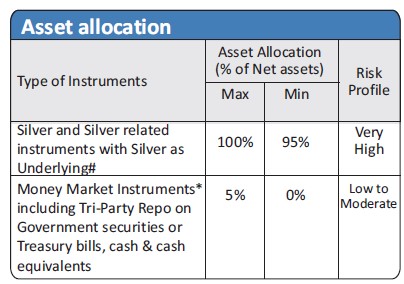

# In accordance with SEBI Circular No. SEBI/HO/IMD/DF2/CIR/P/2021/668 dated November 24, 2021, the Scheme may also participate in Exchange Traded Commodity Derivatives (ETCDs) with Silver as underlying to the extent of 10% of net asset value of the scheme. However, the above limit of 10% shall not be applicable to Silver ETFs where the intention is to take delivery of the physical silver and not to roll over its position to next contract cycle. Such investments shall be made in line with the SEBI regulations as may be specified by SEBI from time to time, subject to prior approval from SEBI, if any.

*Money Market Instruments include commercial papers, commercial bills, treasury bills, and Government securities having an unexpired maturity up to one year, call or notice money, commercial paper, certificate of deposit, Tri[1]Party Repos’ and any other like instruments as specified by Reserve Bank of India from time to time.