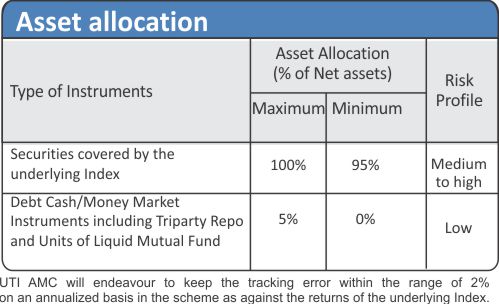

| Investment Objective The investment objective of the scheme is to provide returns that, before expenses, closely correspond to the total returns of the securities as represented by the underlying index, subject to tracking error. However there is no guarantee or assurance that the investment objective of the scheme will be achieved. |

|||||||||

| Date of inception/allotment |

04th September, 2020 | ||||||||

| Fund Manager |

Mr. Sharwan Kumar Goyal, CFA, MMS Managing the scheme since September 2020 Mr Ayush Jain, Assistant Fund Manager, CA. B.Com (Tax) Managing the scheme since May-2022 |

||||||||

| Fund AUM |

Average AUM for the quarter : 3118.28 Crore ended 31st Dec 2023 Fund Size Monthly Average : 2966.24 Crore Closing AUM : 2913.46 Crore |

||||||||

High/Low NAV in the month |

High Growth Option : 49.0199 Low Growth Option : 45.5938 |

||||||||

Total expense ratio (%) |

0.16% | ||||||||

| Market Capitalisation (%) |

|

||||||||

NAV per unit as on 31st January, 2024 |

46.7425 | ||||||||

| Load Structure | Entry Load : Not Applicable as per SEBI guidelines Exit Load : Not Applicable

|

||||||||

| Plans and Options offered | The Scheme does not offer any Plans/Options for investment. |

||||||||

Benchmark Index |

Nifty Bank Index | ||||||||

| Financial Services | 100% |

|

Equity

|

% of NAV

|

| HDFC Bank Ltd. | 26.41 |

| ICICI Bank Ltd | 24.45 |

| State Bank Of India | 10.33 |

| Axis Bank Ltd. | 10.05 |

| Kotak Mahindra Bank Ltd. | 9.96 |

| IndusInd Bank Ltd. | 6.47 |

| Bank Of Baroda | 2.94 |

| Punjab National Bank | 2.17 |

| Federal Bank Ltd. | 2.11 |

| IDFC First Bank Ltd | 2.05 |

| AU Small Finance Bank Ltd | 1.96 |

| Bandhan Bank Ltd. | 1.11 |

| Net Current Assets | 0.00 |

TOTAL |

100.00 |

| Fund Performance Vs Benchmark (CAGR) as on 31st January, 2024 Growth of 10000

|

||||||

| Period | NAV Growth (%) |

Nifty Bank TRI (%) |

Nifty 50 TRI (%) |

NAV Growth () |

Nifty Bank TRI() |

Nifty 50 TRI () |

| 1 Y | 13.99 |

14.09 |

24.35 |

11,399 |

11,409 |

12,435 |

| 3 Y | 15.23 |

15.36 |

18.19 |

15,300 |

15,352 |

16,510 |

| SI* | 21.88 |

21.97 |

21.92 |

19,660 |

19,709 |

19,682 |

The above value is calculated on the basis of the return from Growth Option of the Scheme.

Different plans have a different expense structure. The performance details provided herein are of regular plan.

The current fund manager is managing the scheme since September-2020

*Compounded annualized Growth Rate.

Schemes Managed by Mr. Sharwan Kumar Goyal & Mr Ayush Jain. The performance of the benchmark is calculated using total return index variant of the benchmark index.

% of top 10 stocks |

97.16 |

Median Market Cap ( Cr) |

751,148 |

Weighted Average Market Cap |

683,626 |

Number of Securities |

12 |

All figures given are provisional and unaudited. |

This product is suitable for investors who are seeking*

- Long term capital appreciation

- Investment in securities covered by Nifty Bank Index

*Investors should consult their Mutual Fund Distributor if in doubt about whether the product is suitable for them.