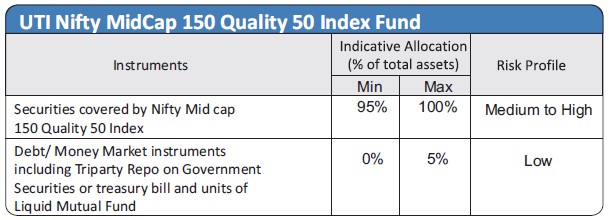

| Investment Objective The investment objective of the Scheme is to provide returns that, before expenses, corresponds to the total return of the securities as represented by the underlying index, subject to tracking error. However, there is no guarantee or assurance that the investment objective of the scheme will be achieved. |

|||||||||

| Inception Date |

August 30, 2023 | ||||||||

| Fund Manager |

Mr. Sharwan Kumar Goyal, B.Com, MMS, CFA Managing the scheme since August 30, 2023. Mr. Ayush Jain, Asst. Fund Manager, B.com (Tax), C.A |

||||||||

| Fund AUM |

Average AUM for the quarter : 5.69 Crore

ended 31st Dec 2023 Fund Size Monthly Average : 3.79 Crore Closing AUM : 3.88 Crore |

||||||||

| Load Structure | Entry Load*: NA Exit Load : Nil *In terms of provision no. 10.4.1 a. of para 10.4 under Chapter 10 of SEBI Master Circular for Mutual Funds No. S E B I / H O / I M D / I M D - P o D 1/P/CIR/2023/74 dated May 19, 2023 no entry load will be charged by the Scheme to the investor effective August 1, 2009 |

||||||||

Benchmark Index |

Nifty Midcap 150 TRI | ||||||||

High/Low NAV in the month |

High Growth Option : 178.7947 Low Growth Option : 171.4429 |

||||||||

Total expense ratio (%) |

0.21% | ||||||||

| Market Capitalisation (%) |

|

||||||||

NAV per unit as on 31st January, 2024 |

178.7947 | ||||||||

| Financial Services | 23% |

| Capital Goods | 13% |

| Healthcare | 11% |

| Automobile & Auto Components | 7% |

| Information technology | 7% |

|

Equity

|

% of NAV

|

| Power Finance Corporation Ltd. | 2.36 |

| REC Ltd | 2.27 |

| Max Healthcare Institute Ltd | 2.12 |

| Adani Power Ltd. | 1.99 |

| Indian Hotels Company Ltd. | 1.59 |

| Persistent Systems Ltd. | 1.57 |

| Yes Bank Ltd. | 1.55 |

| Tube Investments Of India Ltd | 1.50 |

| Coforge Ltd | 1.40 |

| Lupin Ltd. | 1.34 |

| HDFC Asset Management Company Ltd | 1.32 |

| Federal Bank Ltd. | 1.21 |

| Aurobindo Pharma Ltd. | 1.19 |

| IDFC First Bank Ltd | 1.18 |

| Indian Railway Finance Corporation Ltd. | 1.18 |

| Bharat Forge Ltd. | 1.16 |

| Cummins India Ltd. | 1.14 |

| AU Small Finance Bank Ltd | 1.12 |

| CG Power And Industrial Solutions Ltd. | 1.10 |

| MRF Ltd. | 1.10 |

| Hindustan Petroleum Corporation Ltd. | 1.09 |

| Bharat Heavy Electricals Ltd. | 1.08 |

| PB Fintech Ltd | 1.00 |

| Godrej Properties Ltd. | 0.99 |

| APL Apollo Tubes Ltd | 0.98 |

| Tata Elxsi Ltd. | 0.98 |

| Supreme Industries Ltd. | 0.98 |

| Macrotech Developers Ltd | 0.95 |

| Sona BLW Precision Forging Ltd | 0.93 |

| Ashok Leyland Ltd. | 0.93 |

| Others | 60.66 |

| Net Current Assets | 0.03 |

TOTAL |

100.00 |

% of top 10 stocks |

17.69 |

Median Market Cap ( Cr) |

48,317

|

Weighted Average Market Cap |

58,890

|

Number of Securities |

150

|

All figures given are provisional and unaudited. |

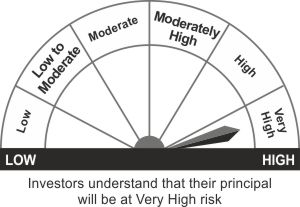

This product is suitable for investors who are seeking*

- Long term investment

- Investment in securities covered by Nifty Midcap 150 TRI

*Investors should consult their Mutual Fund Distributor if in doubt about whether the product is suitable for them.