| Investment Objective The investment objective of the fund is to endeavour to provide returns that, before expenses, closely track the performance and yield of Gold. However, the performance of the scheme may differ from that of the underlying asset due to tracking error. There can be no assurance or guarantee that the investment objective of the UTI Gold ETF will be achieved. |

||

| Inception Date |

17th April, 2007 | |

| Fund Manager |

Mr. Niranjan Das Postgraduate in Commerce (M. Com), MBA in Finance. Managing the Scheme since February 2022. | |

| Fund AUM |

Average AUM for the quarter : ₹ 613.58 Crore ended 31st Dec 2023 Fund Size Monthly Average : ₹ 634.10 Crore Closing AUM : ₹ 936.84 Crore | |

High/Low NAV in the month |

High Growth Option : ₹ 54.4729 Low Growth Option : ₹ 52.8928 |

|

Total expense ratio (%) |

0.46% | |

Load Structure |

Entry Load : Nil Exit Load : Nil |

|

NAV per unit as on 31st January, 2024 |

₹ 53.4276 | |

| Minimum Application Amount | On the stock exchange: Minimum 1 Unit can be bought/sold in demat form at prevailing prices quoted on the NSE and on any other exchange where they are traded. Direct creation of Units with the Fund: Authorized Participants / others can create the Units in demat form in exchange against prescribed portfolio deposit and the applicable cash component at NAV based prices atleast in one creation unit. |

|

Benchmark Index |

Price of Gold | |

| Gold | 99% |

| NCA | 1% |

|

Equity

|

% of NAV

|

| Gold Bullion | 99.73 |

| Net Current Assets | 0.63 |

TOTAL |

100.00 |

| Fund Performance Vs Benchmark (CAGR) as on 31st January, 2024 growth of ₹ 10000

|

||||||

| Period | NAV Growth (%) |

Price of Gold (%) |

CRISIL 1 Year T-Bill Index (%) |

NAV Growth (₹) |

Price of Gold (₹) |

CRISIL 1 Year T-Bill Index (₹) |

| 1 Year | 8.51 |

9.10 |

6.91 |

10,851 |

10,910 |

10,691 |

| 3 Years | 7.51 |

8.48 |

5.00 |

12,426 |

12,766 |

11,576 |

| 5 Years | 12.39 |

13.47 |

5.55 |

17,938 |

18,817 |

13,103 |

| Since inception* | 10.88 |

11.93 |

6.19 |

56,709 |

66,441 |

27,433 |

The above value is calculated on the basis of the return from Growth Option of the Scheme.

Different plans have a different expense structure. The performance details provided herein are of regular plan.

*Compounded annualized Growth Rate.

Schemes Managed by Mr. Niranjan Das. The performance of the benchmark is calculated using total return index variant of the benchmark index.

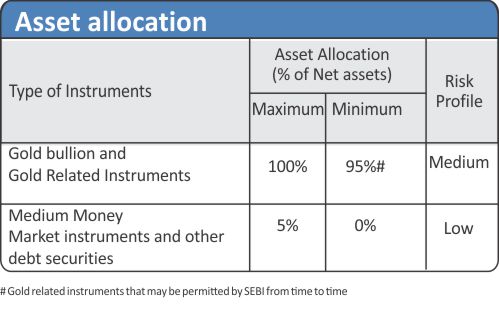

This product is suitable for investors who are seeking*

- Returns that, before expenses of the Scheme, closely track the performance and yield of Gold

- Investment predominantly in gold and gold related instruments

*Investors should consult their Mutual Fund Distributor if in doubt about whether the product is suitable for them.